Stocks and bonds? That’s the beginner league. The real wealth isn’t found on Wall Street… it’s built on the frontier. iVenturer’s latest Alternative Investments Market Analysis is your map to the hidden gems.

Stop following the crowd. Start leading it. Pass onboarding to join iVenturer Foundation.

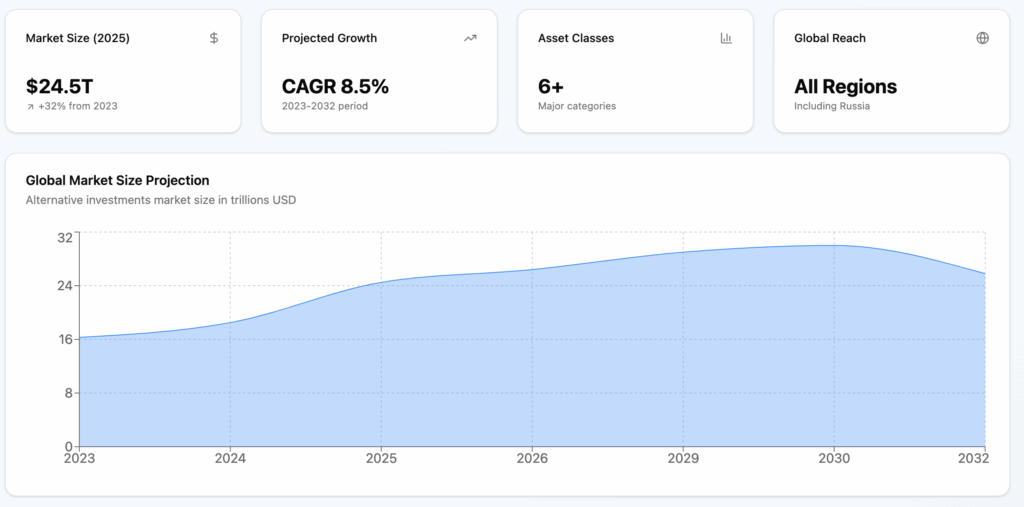

Market Size and Growth:

– Projected to reach $26.4 trillion by the end of 2025 (CoinLaw).

– Expected to reach $29 trillion by 2029 (CAIS).

– Global alternative investment funds (AIFs) market valued at $12.8 trillion in 2023, projected to reach $25.8 trillion by 2032 (Allied Market Research).

– Expected to exceed $17 trillion by 2025 (Preqin, cited by WEF).

– Expected to reach $24.5 trillion in less than five years, from $16.3 trillion at the end of 2023 (RBC Wealth Management).

– Expected to reach $30 trillion by 2030 (BlackRock).

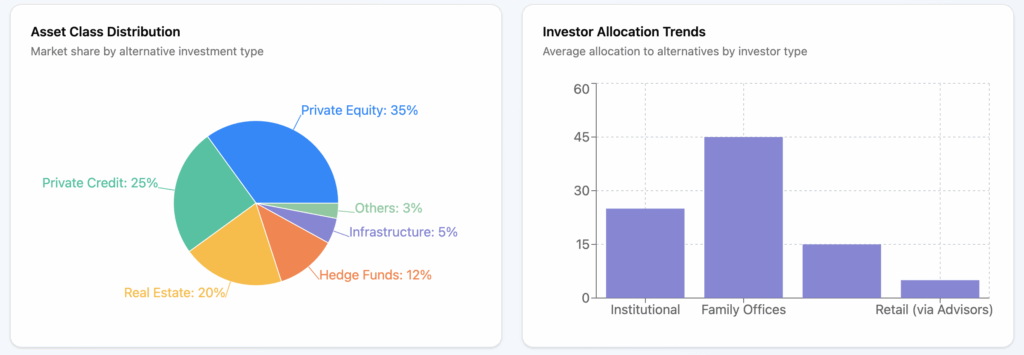

Types of Alternative Investments:

– Private Equity

– Private Debt

– Hedge Funds

– Real Estate

– Commodities

– Collectibles (Art, Antiques)

– Infrastructure

– Structured Products

– Derivatives

– Cryptocurrency

– NFTs

– Precious Metals

Growth Drivers:

– Search for higher returns in a low-interest-rate environment.

– Diversification benefits and reduced correlation with traditional assets.

– Increased accessibility for individual investors.

– Long-term investment horizons.

– Specific themes like energy transition and sustainability&

Challenges:

– Data accessibility and comparability.

– Complex and heterogeneous deal structures.

– Regulatory uncertainties.

– Geopolitical factors and military conflicts.

– Election uncertainties.

– Rising trade barriers.

– Operational complexities

Key Players (Global):

– JPMorgan Chase and Co.

– Goldman Sachs Group Inc.

– BlackRock Inc.

– Fidelity Investments

– The Vanguard Group

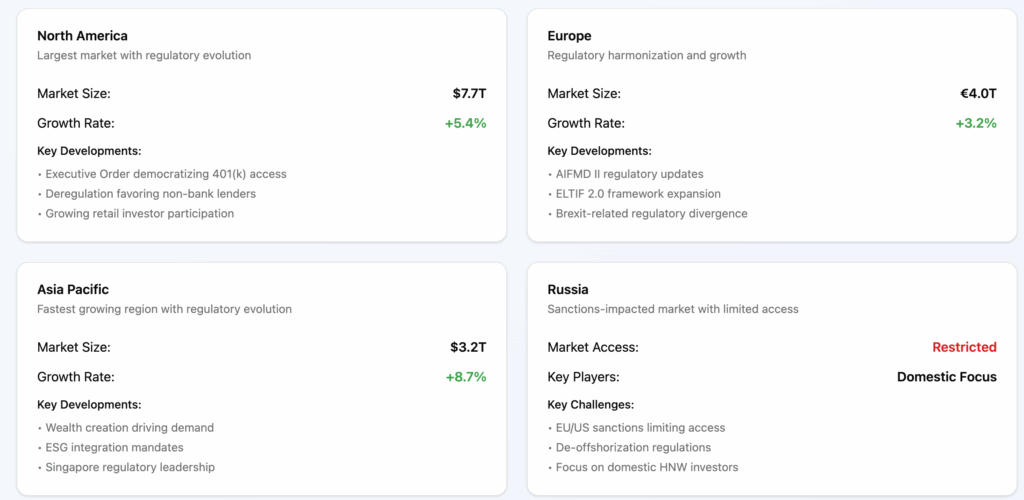

Alternative Investments Market in Russia

Regulations and Sanctions:

– EU sanctions (Council Regulation 833/2014, Article 5f) prohibit selling transferable securities or units in collective investment undertakings to Russian entities/persons.

– US sanctions (31 CFR Part 589, Ukraine-/Russia-Related Sanctions Regulations) prohibit new investment in Crimea region and prohibit US persons from purchasing new and existing debt and equity securities issued by entities in the Russian Federation.

– Russian laws regulating foreign investments have been considerably amended in 2023 to extend scope and strengthen control.

– Russia’s “De-offshorization Law” (376-FZ) since 2015 requires Russian investors to disclose foreign assets.

Key Players (Russia):

– Admitad Invest (venture capital)

– Bright Capital

– Sberbank Asset Management

– VTB Capital Investment Management

– Gazprombank Asset Management

– Russian Internet Leaders (Yandex, Mail.Ru Group, Sberbank) are active VC investors.

Market Characteristics:

– Main audience for hedge funds in Russia is qualified high-net-worth individuals and family offices.

– Sanctions and market volatility impact investment decisions.

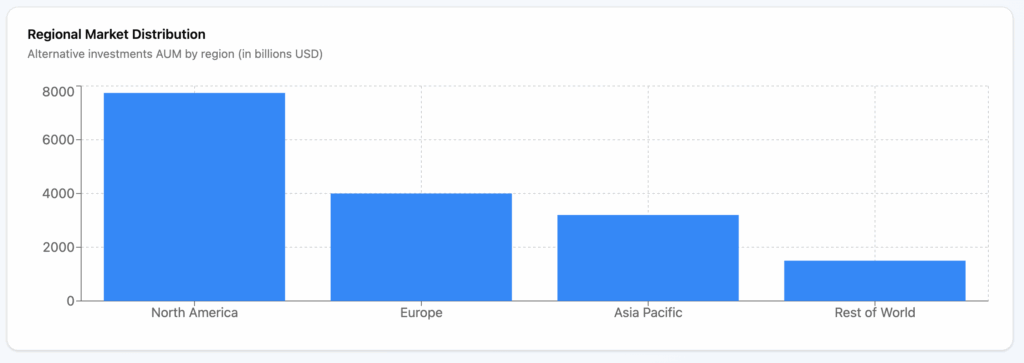

Regional Market Trends and Regulatory Changes

North America:

– Market Growth: Continues upward trajectory, AUM forecasted to hit $7,741 billion (CoinLaw).

– Regulatory Changes:

– Executive Order signed on August 7, 2025, aimed at democratizing access to alternative assets for 401(k) plan investors, potentially allowing crypto, private equity, and real estate in 401(k)s.

– Regulatory shifts generally aim to enhance transparency, protect investors, and mitigate systemic risk.

– Deregulation rebalances lending, shifting market share towards non-bank lenders.

Europe:

– Market Growth: European alternatives showing divergence in asset class prosperity. AuM estimated to have reached €4 trillion by Q4 2024.

– Regulatory Changes:

– UK and EU diverging on regulatory frameworks (e.g., AIFMD II changes not implemented in UK).

– HM Treasury and FCA in UK consulting on overhauling Alternative Investment Fund Managers (AIFMs) regulation.

– ELTIF 2.0 regulation brings new opportunities for European AIFs, aiming to finance the real economy.

– New rules adopted by the Council on February 26, 2024, enhance integration of asset management markets and modernize regulatory framework.

Asia:

– Market Growth: On a trajectory of unprecedented growth, AUM expected to reach significant levels by 2025.

– Regulatory Changes:

– Regulatory transformation aimed at aligning with global standards, particularly in countries like Singapore.

– Evolving global regulations increasingly mandating ESG disclosures and practices.

– New guidance in Hong Kong allows alternative funds to be listed even if they mainly invest in alternative assets.

– Emerging markets in Southeast Asia are gaining traction due to favorable regulatory changes.

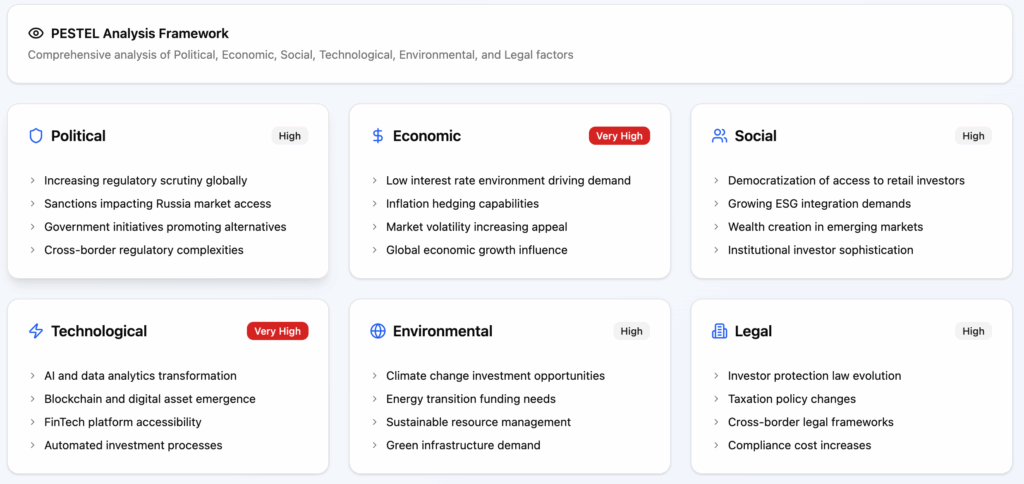

PESTEL Analysis of the Alternative Investments Market

Political:

– Global Regulatory Landscape*: Increasing scrutiny and evolving regulations (e.g., AIFMD in Europe, SEC oversight in the US) aimed at enhancing transparency, investor protection, and systemic risk mitigation.

– Sanctions and Geopolitical Tensions: Sanctions against Russia significantly impact investment flows and market access. Geopolitical conflicts globally introduce uncertainty and can deter investment in affected regions.

– Government Initiatives: Policies promoting alternative investments (e.g., US Executive Order democratizing access for 401(k) plans) can drive growth.

Economic:

– Interest Rate Environment: Low-interest-rate environments historically drive investors towards alternatives for higher yields. Rising rates can make traditional assets more attractive, but alternatives still offer diversification.

– Inflation: Alternative assets like real estate and commodities can act as inflation hedges, increasing their appeal during inflationary periods.

– Global Economic Growth: Overall economic health influences investor confidence and capital availability for alternative investments.

– Market Volatility: Volatile traditional markets often push investors towards the perceived stability and uncorrelated returns of alternatives.

Social:

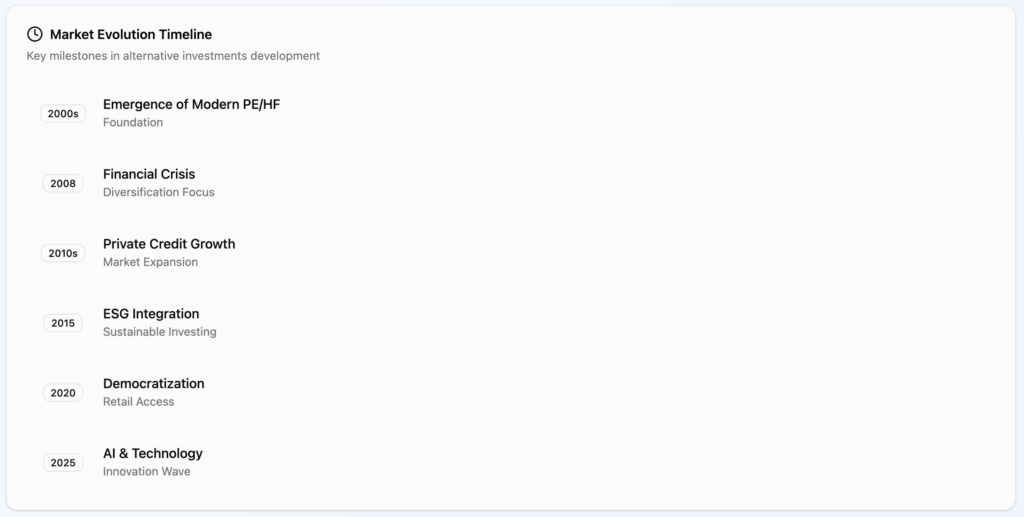

– Democratization of Access: Growing demand from retail and individual investors for access to alternative assets, previously exclusive to institutional investors.

– ESG Integration: Increasing investor focus on Environmental, Social, and Governance (ESG) factors, leading to a rise in sustainable and impact investing within alternatives.

– Wealth Creation: Continued wealth creation globally, particularly in Asia, fuels demand for sophisticated investment offerings.

Technological:

– Data Analytics and AI: Advanced data analytics and AI are transforming due diligence, risk management, and investment strategies in alternative assets.

– Blockchain and Digital Assets: The emergence of cryptocurrencies and NFTs as alternative investment classes, alongside blockchain technology for tokenization and fractional ownership.

– FinTech Innovation: Technology platforms are making alternative investments more accessible and efficient for a broader range of investors.

Environmental:

– Climate Change and Energy Transition: Significant investments are directed towards renewable energy, green infrastructure, and sustainable technologies, driving growth in specific alternative asset classes.

– Resource Scarcity: Growing awareness of resource scarcity influences investments in commodities and sustainable resource management.

Legal:

– Investor Protection Laws: Regulations designed to protect investors, particularly as alternative investments become more accessible to retail investors.

– Taxation Policies: Evolving tax laws and incentives can significantly impact the attractiveness and structure of alternative investments.

– Cross-border Regulations: Complexities arising from differing legal frameworks across jurisdictions, especially for global alternative investment funds.

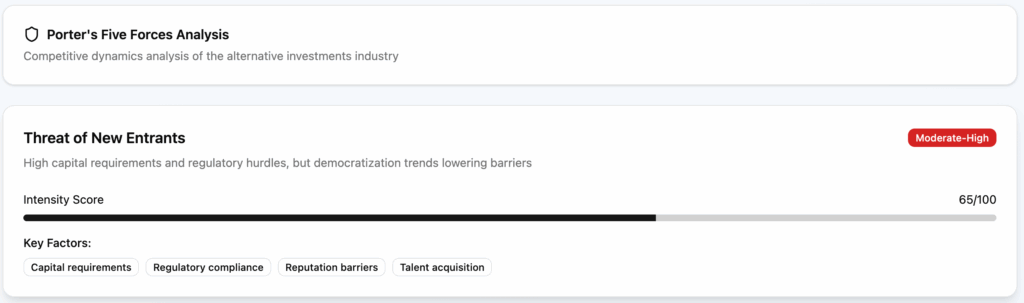

Porter's Five Forces Analysis of the Alternative Investments Market

Threat of New Entrants: Moderate to High

– Capital Requirements: High capital requirements for establishing and operating alternative investment funds (e.g., private equity, hedge funds) can be a barrier.

– Regulatory Hurdles: Strict and evolving regulatory frameworks (e.g., AIFMD, SEC regulations) create significant compliance costs and complexities for new entrants.

– Reputation and Track Record: Established players benefit from strong reputations and long track records, making it difficult for new firms to attract investors.

– Talent Acquisition: Access to experienced investment professionals and specialized talent is crucial and can be a challenge for new entrants.

– Democratization: The trend towards democratizing alternative investments (e.g., through technology platforms) could lower barriers for new entrants focusing on retail investors.

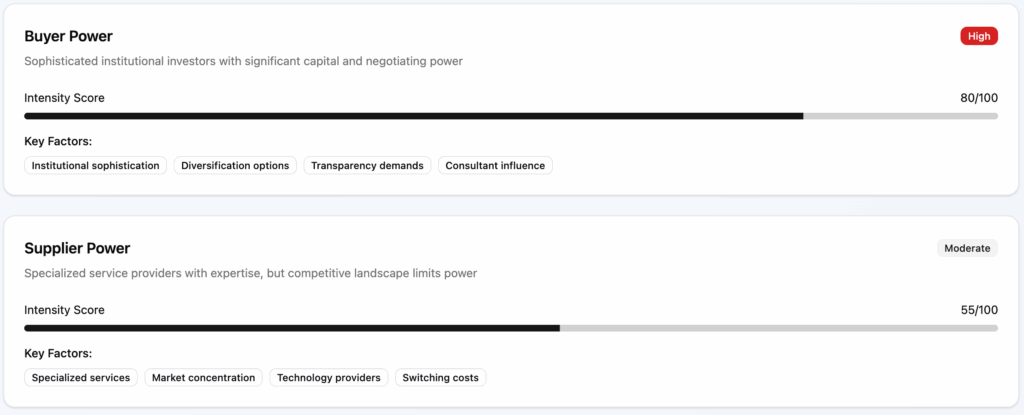

Bargaining Power of Buyers (Investors): High

– Sophistication of Institutional Investors**: Large institutional investors (pension funds, endowments, sovereign wealth funds) have significant capital and expertise, allowing them to demand favorable terms, lower fees, and customized solutions.

– Diversification Options: Investors have a wide range of alternative investment options globally, increasing their ability to choose and negotiate.

– Transparency Demands: Growing demand for greater transparency in fees, performance reporting, and underlying assets empowers investors.

– Consultant Influence: Investment consultants play a significant role in advising institutional investors, further amplifying buyer power.

Bargaining Power of Suppliers (Service Providers): Moderate

– Specialized Services: Suppliers include legal firms, auditors, fund administrators, prime brokers, and data providers. Many offer specialized services crucial to alternative investments.

– Concentration: Some segments of service providers (e.g., top-tier legal or audit firms) may have higher bargaining power due to their expertise and limited alternatives.

– Technology Providers: As technology becomes more integral, specialized FinTech providers gain influence.

– Switching Costs: While switching service providers can incur costs, the competitive landscape among providers generally keeps their bargaining power in check.

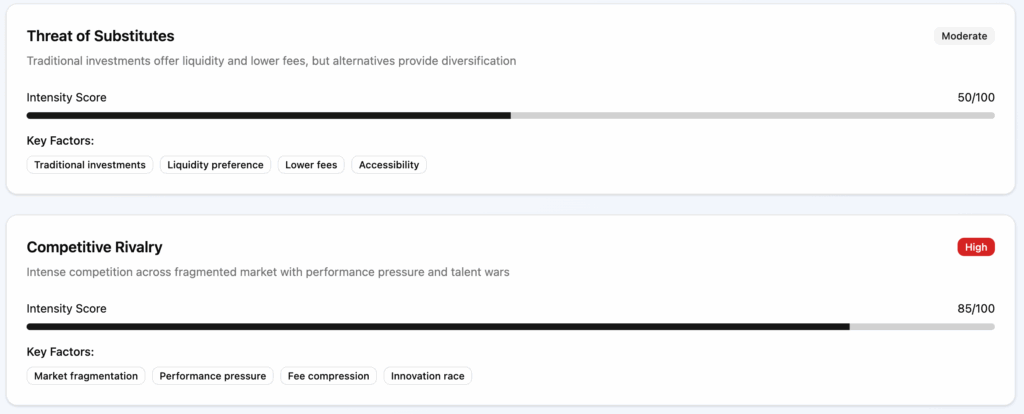

Threat of Substitute Products or Services: Moderate

– Traditional Investments: Public equities, bonds, and cash remain primary investment alternatives. In periods of strong performance or rising interest rates in traditional markets, some capital may flow away from alternatives.

– Liquidity Preference: Traditional investments generally offer higher liquidity, which can be a strong draw for investors with shorter time horizons or liquidity needs.

– Lower Fees: Traditional investment products typically have lower management fees compared to alternative investments.

– Accessibility: Traditional investments are generally more accessible to a wider range of investors without specific accreditation requirements.

Intensity of Rivalry: High

– Fragmented Market: While large players exist, the alternative investments market is diverse and fragmented across various asset classes and strategies, leading to intense competition.

– Performance Pressure: Funds are under constant pressure to deliver strong returns to attract and retain capital, leading to aggressive strategies and competition for deals.

– Fee Compression: Increased competition and investor demands are leading to pressure on management fees.

– Talent War: Fierce competition for top talent in investment management, deal sourcing, and specialized analysis.

– Innovation*: Continuous innovation in product offerings, investment strategies, and technology to gain a competitive edge.

Detailed Performance and Fee Structures by Asset Class

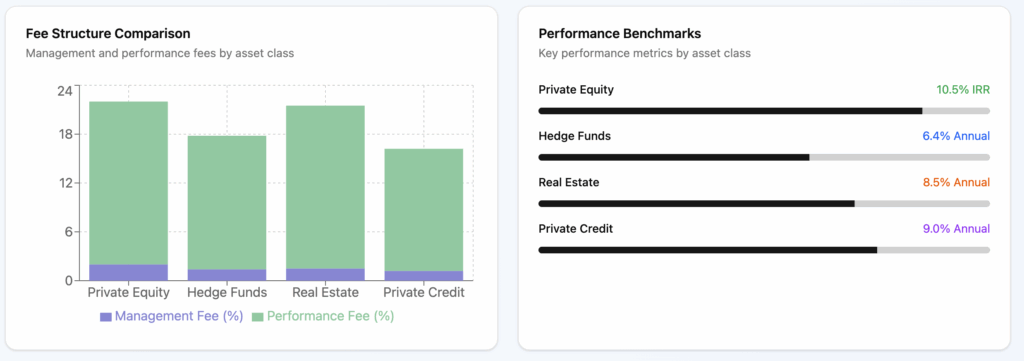

Private Equity:

– Performance: Annualized returns of 10.3% (2022-2023) compared to 0.2% for public stock market equivalent (CAIA). Preqin reports 10.5% annualized return since 2000.

– Fees:

– Management Fees: Typically 1.25% to 2.00% of committed capital for primary funds, or 1%-2% of AUM.

– Carried Interest (Performance Fee): Typically 20% of profits, often after a hurdle rate.

– Deal Fees: Range from 2-4% of transaction value.

– Monitoring Fees: Charged by PE firm to portfolio company for oversight.

– True Cost: Some analysis suggests actual fees paid by LPs are closer to 1% of commitments than 2%.

Hedge Funds:

– Performance: Average returns around 6.4% in 2023. Historically, some top funds have generated significantly higher returns (e.g., Medallion Fund 66% before fees).

– Fees:

– “2 and 20” Model: Standard fee structure: 2% management fee (on AUM) and 20% performance fee (on profits).

– Current Trends: Average management fees have decreased to around 1.35-1.50%, and performance fees to 16.01-19.00%.

– Hurdle Rate: Performance fees are often charged above a specified minimum threshold.

Real Estate (Alternative Investments):

– Performance: Varies significantly by property type, location, and strategy (core, value-add, opportunistic).

– Fees:

– Acquisition Fees: Charged at the time of property acquisition.

– Asset Management Fees: Typically 1% to 2% of invested equity annually.

– Disposition Fees: Charged when the property is sold.

– Promote/Carried Interest: Similar to private equity, a share of profits after investors achieve a certain return (hurdle rate).

– Other Fees: Development fees, property management fees, financing fees.

Investor Demographics and Allocation Trends

Institutional Investors:

– Current Allocation: Average allocation to alternatives has increased from 18.4% to 20% over the last five years (Preqin 2024). Some institutional investors, particularly pensions and endowments, allocate as high as 25-40%.

– Driving Factors: Pursuit of diversification, enhanced returns, and inflation protection. Increasing complexity in the market is leading nearly 40% of institutions to expand their roster of asset managers.

– Product Prioritization: Asset managers are prioritizing alternatives to meet evolving investor demands.

High Net Worth (HNW) Individuals and Family Offices:

– Allocation: Family offices commit an average of 45% of their investment portfolios to private investments (J.P. Morgan survey).

– Motivation: Similar to institutional investors, HNWIs seek diversification and higher returns, often with a longer investment horizon.

Retail Investors:

– Increasing Accessibility: Regulatory changes and FinTech innovations are democratizing access to alternative investments for a wider group of investors, including Millennials and Gen Z.

– Lower Barriers: Individual investors typically seek lower minimum investment thresholds.

– Advisor Adoption: 92% of surveyed advisors already allocate to alternatives, with 91% planning to increase their allocations (Mercer 2025). Private debt (89%) and private equity (86%) lead in popularity among advisors.

"Alternative investments are larger than ever, sitting at $22 trillion in assets under management, or 15% of global assets under management (CAIA). Shift from Traditional: Investors are increasingly looking beyond traditional 60/40 portfolios. Emerging Markets: Latin America, Africa, Southeast Asia and even Russia are gaining significant traction and attracting investors."

Aleksei Olin Tweet