Introduction: The Math of Rejection—Why 99% of Ideas Are Systemically Doomed

Venture Capital (VC) is a closed world where success is measured by the asymmetry of risk and reward. If 99% of startups face investor rejection , this does not reflect a mass shortage of good ideas. It reflects a rigid, unforgiving VC economic model that acts as a giant filter, automatically discarding projects that do not align with its mandate, regardless of their viability as a traditional small business.

The VC Systemic Requirement: Investing in Asymmetry

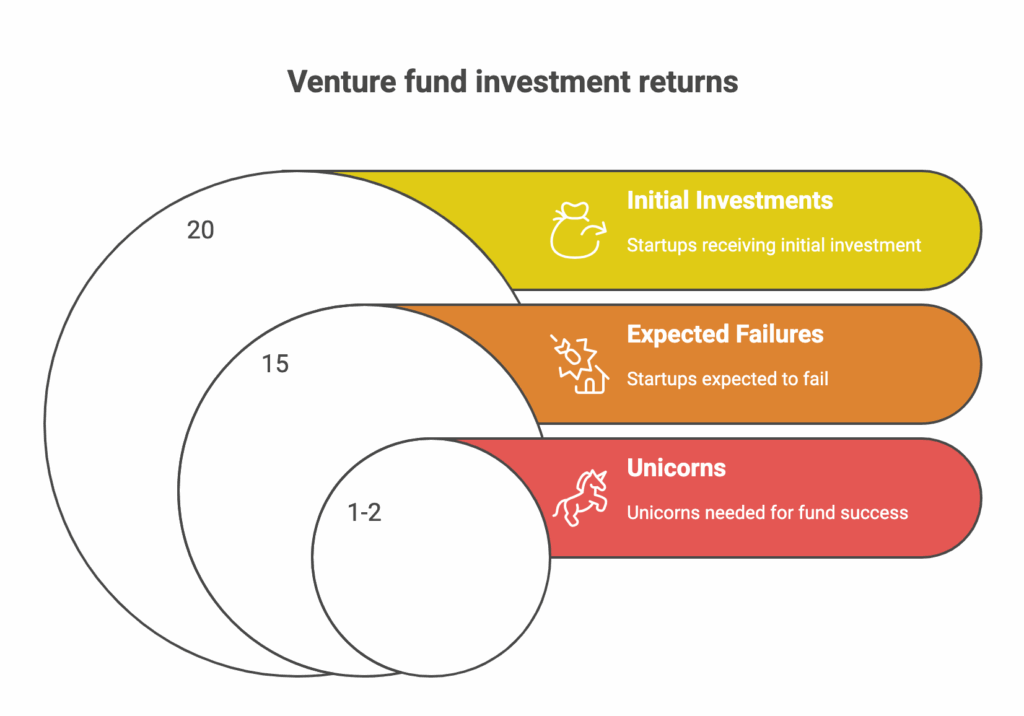

Venture funds operate on a principle fundamentally different from traditional investing. They are not seeking stable, moderate returns. A fund that raises 100 million and invests in 20 startups expects 75% of those companies will never return the capital invested, a harsh but realistic statistic. Therefore, for the fund as a whole to deliver a profit (typically a 3x or greater return), one or two “unicorns” (companies valued over 1 billion) must account for the return of the entire fund and its profit.

This model imposes a critical Systemic Requirement: the project must have the potential for exponential, not linear, growth, with the goal of becoming a global market leader. If even a small market share cannot generate an attractive return sufficient to achieve this multi-fold return, the project is deemed unfit for VC funding.

The Mandate Fit Filter: The Primary Reason for Rejection

The most common reason for rejection is not that the idea is poor, but that it does not fit the VC model. Early-stage investors, reviewing hundreds of pitches, first apply the Mandate Filter:

Stage and Sector: The founder must ensure they align with the stage (Pre-Seed/Seed) and sector the fund invests in. Pitching a Pre-Seed startup to a Growth Fund is a waste of time.

Total Addressable Market (TAM): If the Total Addressable Market (TAM) is not large enough to potentially deliver a 100x return upon capturing a dominant share, the project is automatically eliminated. In this chain of cause and effect, a good idea combined with a too-small market (TAM) for the required exponential return results in the project being labeled “Not Fundable”.

Five Pillars of Due Diligence (DD Pillars): Standard Early-Stage Failure Points

Venture investors evaluate startups based on five interconnected pillars. Failure in even one of these, especially at the early stage where risk is extremely high, can lead to immediate rejection. At the Pre-Seed and Seed stages, Due Diligence primarily focuses on the team, the market opportunity, and the core idea.

Pillar 1: The Founding Team—The Highest Risk

In the early stages, investing is fundamentally a bet on people. Investors emphasize the team’s Ability to Execute, as the product and market will likely change (Pivot), but the quality of the team must remain constant.

Assessing Competencies and Commitment

Investors meticulously examine the founders’ professional and educational backgrounds, their relevant skills, and industry experience. Commitment is critical: the investor looks for evidence of enthusiasm, passion, and, most importantly, full-time dedication to the project.

Team-Related Red Flags

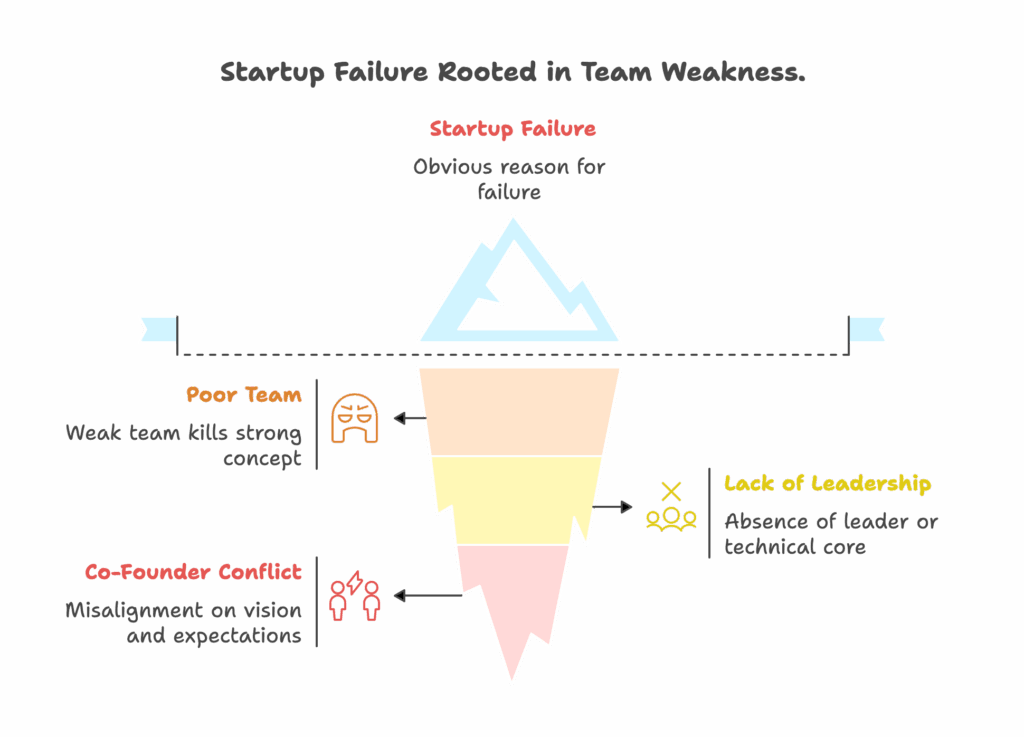

A Poor Team: A good idea with a weak team is virtually guaranteed to fail. A weak team will inevitably kill even the strongest concept.

Lack of a Leader or Technical Core: The team must have a clear, expressive leader. In a technology startup, the absence of a co-founder with deep technical expertise (CTO) or a lead developer is a critical flaw, as the investor lacks confidence in the internal ability to build a product quickly and effectively.

Co-Founder Conflict or Misalignment: Co-founders must be more than just compatible; they must be fully aligned on expectations, long-term vision, and role distribution. Tension between founders or a lack of “Sportsmanship” toward each other or external partners is a strong behavioral red flag

Pillar 2: Market and Problem (Market Opportunity)

The market must be large enough to justify the exponential VC bet. However, simply naming a large TAM is insufficient; you must prove you are solving a genuinely acute problem.

From “Nice-to-Have” to “Must-Have”

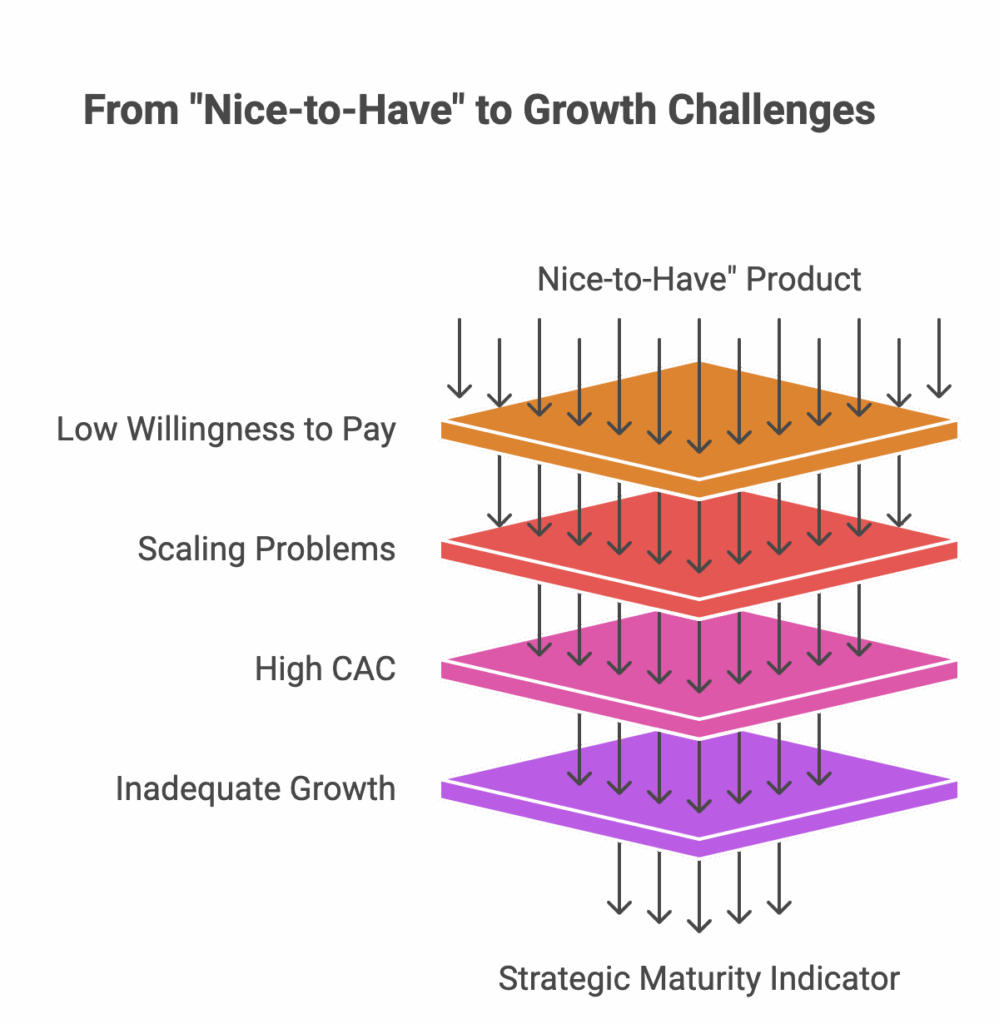

The product must solve what investors often call a “hair on fire problem,” not just something “mildly agitating”. Investors seek projects that make the target audience’s (TA) life easier and more interesting, but primarily—solve a critical pain.

The product must be a “must have” for the TA, not merely a “nice to have”. If the founder focuses on a “nice-to-have,” the investor sees the following chain of causation: low customer willingness to pay → scaling problems → high Customer Acquisition Cost (CAC) → inadequate growth. Thus, the quality of the problem being solved serves as an indicator of the founder’s strategic maturity and the depth of their customer discovery.

Pillar 3: Product and Traction (Product & Validation)

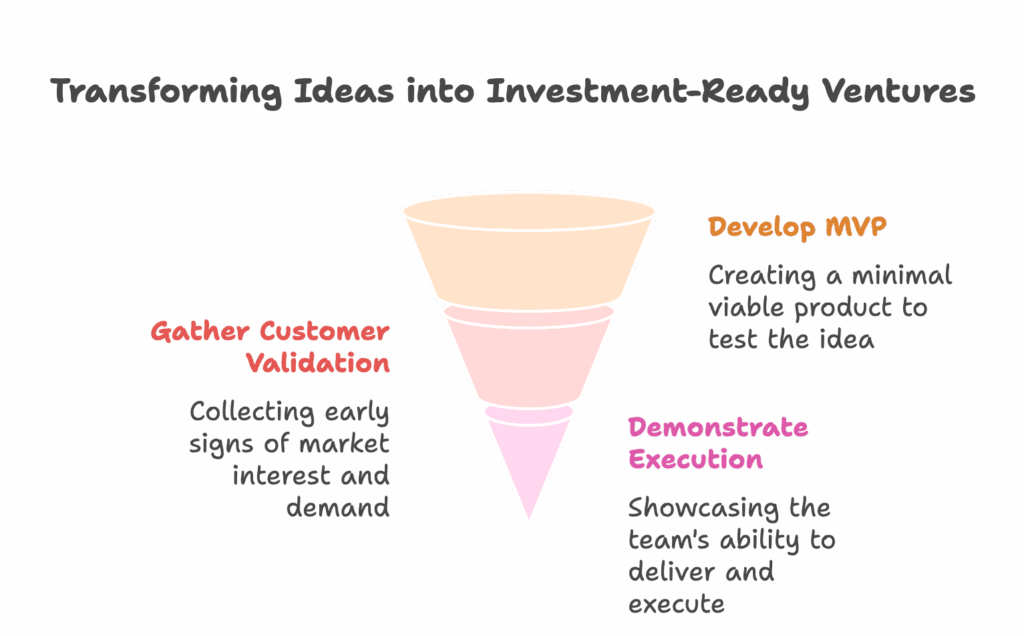

At the early stage, VCs do not expect millions in revenue, but they demand proof of concept. The idea alone is considered extremely risky and suggests an unserious approach to securing investment.

The Requirement for Proof of Execution

The fastest deal killer is a pitch that begins with the phrase: “I have an idea”. The investor needs a compelling reason to believe the team “can pull it off”.

At the Pre-Seed/Seed stage, this means having an MVP or prototype and early signs of customer validation, such as initial sales, partnerships, or active product usage. This evidence serves not only as confirmation of the idea’s viability but also as proof of the team’s technical capacity for execution.

Pillar 4: Business Model and Strategy (Model & Vision)

VCs invest in exponential growth, not short-term profit. This requires a decade-long vision.

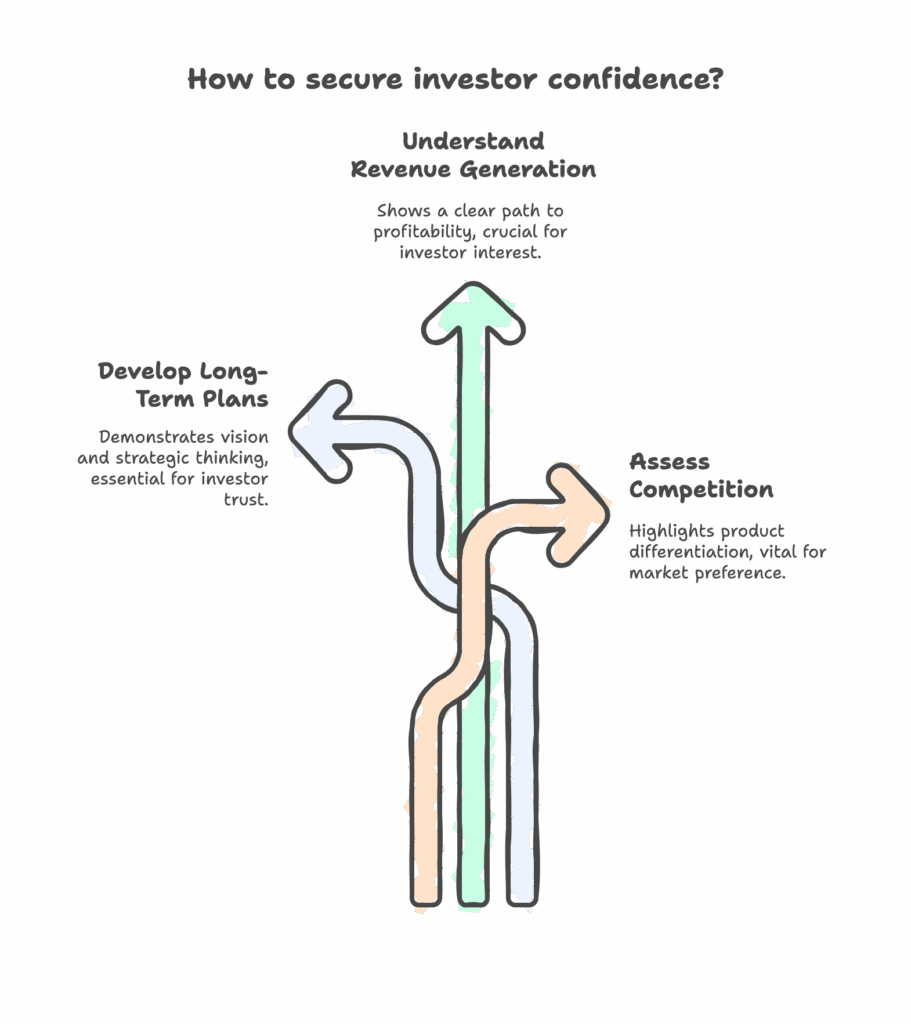

Lack of Long-Term Planning

A key mistake is the unwillingness or inability to develop medium and long-term business plans for 3, 5, or 10 years ahead. Investors must see a clear path to market leadership and a precise understanding of how the company will generate revenue and the key levers that affect future profitability. Underestimating the competition is also a critical error; the founder must clearly answer why the buyer will prefer their product.

Pillar 5: Financial, Legal, and Operational Hygiene (Hygiene Check)

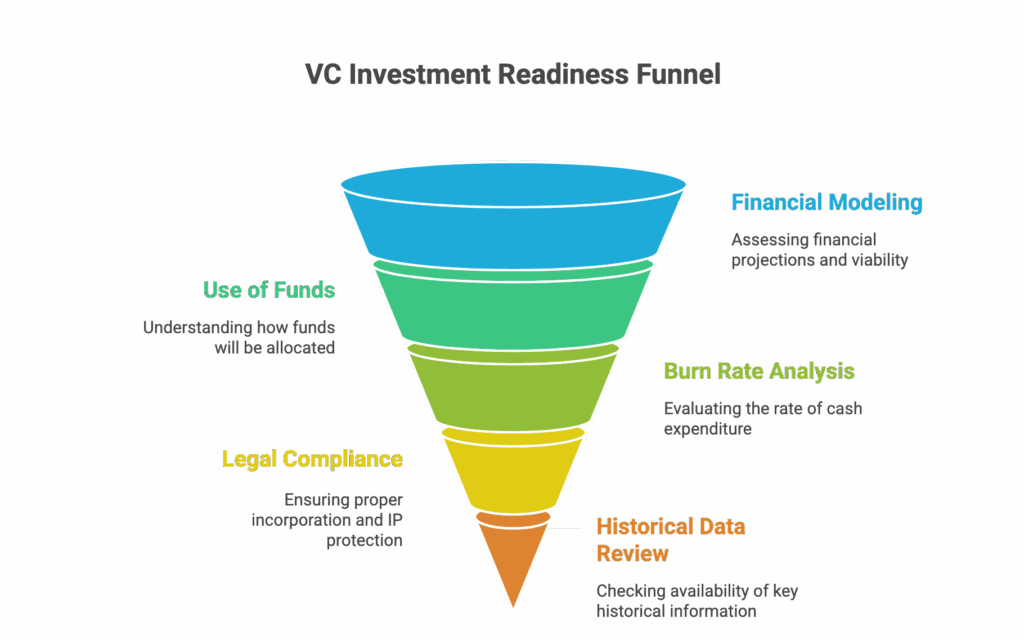

At the early stage, financial DD requirements are relatively simple , but non-compliance is one of the most powerful behavioral red flags.

Legal and Financial Requirements

For Pre-Seed/Seed VCs, basic financial modeling, a clear explanation of the Use of Funds, and the Burn Rate are required. Legally, the company must be correctly incorporated, and Intellectual Property (IP), if any, must be protected. The unavailability of important historical information, such as data on previous rounds or key KPIs, is a serious red flag.

Hygiene as a Mirror of Maturity

The most critical operational DD red flags that instantly kill a deal are related to discipline:

Verification of separate bank accounts for the business.

Verification of no commingling of personal and business expenses.

A breach of financial hygiene is not just an accounting error. It is a proxy indicator of operational immaturity and incompetence. If a founder cannot maintain basic discipline in managing their own funds, the investor cannot entrust them with millions of external capital. This creates potential legal and tax risks that can torpedo future funding rounds, leading to automatic rejection.

Catalog of Fatal Errors: Five Instant Trust Killers (Red Flags)

Beyond failing the systemic mandate and not meeting DD requirements, there are behavioral and strategic errors that instantly destroy the most crucial element in the venture world—trust.

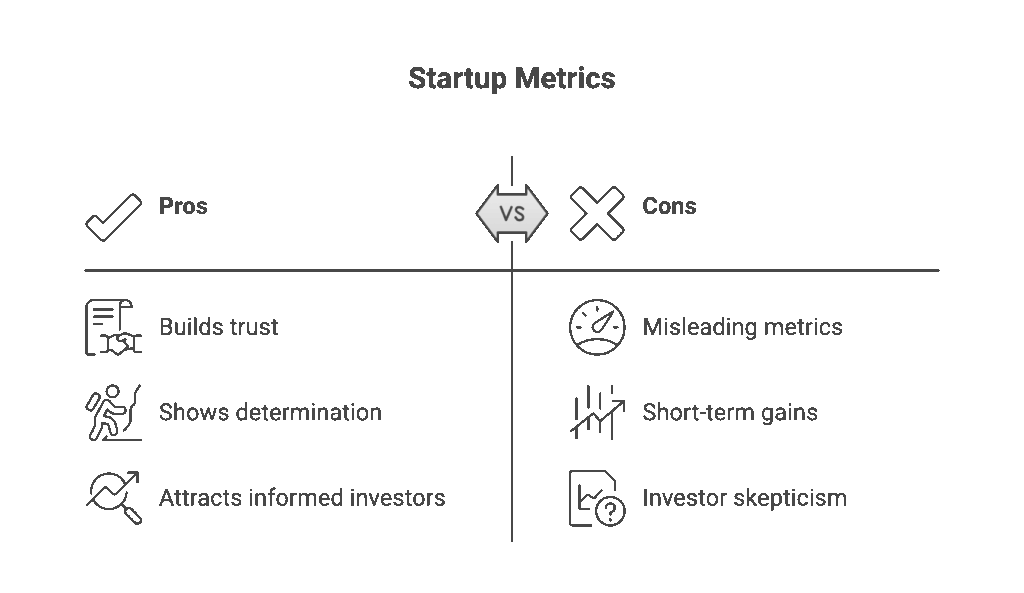

Fatal Error 1: Deception, Metric Distortion, and the Trust Crisis

Any, even the slightest, hint of general lack of honesty is an automatic and irreversible deal killer. In the VC industry, which relies on long-term partnerships and reputation, lying is a toxic stain.

Misleading Metrics is the most frequent violation. Founders often exaggerate figures in an attempt to appear more successful. However, investors are well aware that most startups, even successful ones, face difficulties and have inconsistent growth. It is much better to present honest metrics that show the team’s determination than polished data.

Dishonesty does not just deter; it signals the founder’s willingness to lie in business, creating a large liability risk. The startup industry is small, and reputations travel quickly. If an investor catches a founder lying or distorting historical data, they lose trust in the entire plan and vision, which is impossible to verify. VCs openly share information about dishonest founders, which can permanently close doors to further funding.

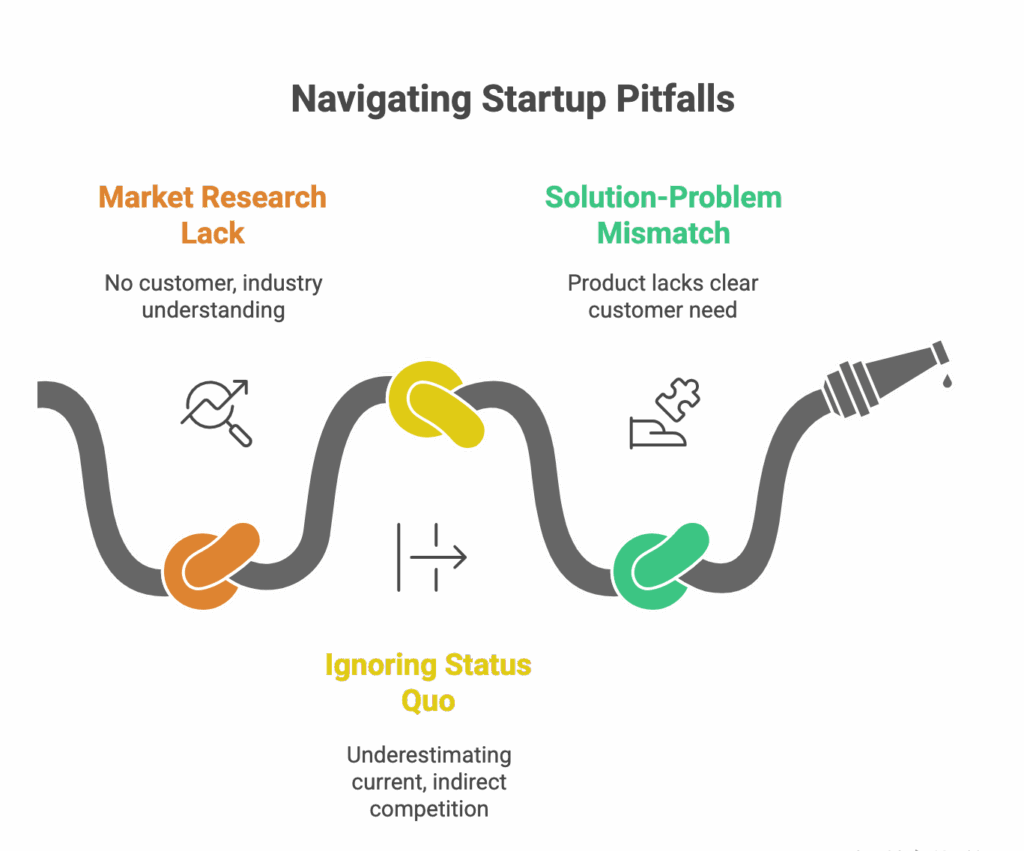

Fatal Error 2: “We Have No Competition”

This statement is a strategic naivety red flag that makes experienced investors “cringe”. A lack of competitors is a myth. If there are no competitors, it likely means either the market does not exist, or the problem is not worth solving.

Why it is fatal:

Lack of Market Research: The founder demonstrates they have not conducted proper customer discovery and do not understand their industry.

Ignoring the Status Quo: There is always competition in the form of the status quo (how people solve the problem today without your product) and indirect competitors (alternative approaches to solving the problem).

Solution Looking for a Problem: If the founder cannot name how customers currently manage without their product, it is a signal they might be building a Solution Looking for a Problem

Investors want to see a thoughtful analysis of the competitive landscape and a clear articulation of a unique differentiation that genuinely matters to the customer.

Fatal Error 3: Early Exit Planning

Including a slide with an M&A plan or another quick exit strategy in the pitch deck at the early stages is one of the biggest red flags for VCs.

Venture capital invests not to help a founder sell the company in three years. They invest to build a market leader valued in the billions of dollars. Early exit planning signals the founder’s short-term motivation, which does not align with the fund’s long-term (7-10 year) horizon. This creates the impression that the founder wants to “retire” rather than build an industry-changing company.

Fatal Error 4: Inability to Answer Basic Strategic Questions

The founder must have a crystal-clear understanding of the company’s current status, the development plan, and, most importantly, how the raised funds will be used (Use of Funds).

Pitching and Communication Problems

Weak Communication of Vision: Inability to explain the essence of the product in simple, understandable sentences that can be grasped by both a technical investor and a novice. If the investor cannot understand the value in the allotted time, it is an instant rejection.

Unpolished Deck: A sloppy, inconsistent presentation deck often prevents the team from even securing a first meeting.

Fatal Error 5: Avoiding Partnership and Inability to Work with Investors

The inability to work with investors and misunderstanding their role can be fatal for the business. Venture capital offers not just money (Level 1: Money quickly), but also valuable experience accumulated from dozens of failed and successful cases.

The Danger of “The Smartest Person in the Room”: Investors note that if a founder considers themselves “the smartest person in the room” and is unwilling to listen to advice or feedback, it complicates the partnership. Such a founder demonstrates an inability to learn and iterate—skills critical for survival. The investor sees this founder not as a manageable partner, but as a high-risk asset that will likely make “very silly mistakes”. Sportsmanship and a willingness to work together are behavioral criteria for success.

Detailed Checklist: What a Successful Pitch Needs

To pass the rigid selection process, a founder must systematize preparation, focusing not just on the idea, but also on discipline, traction, and strategic maturity.

Overcoming Rejection: Validation Before the Pitch

Before entering the fundraising process, the founder must conduct a thorough analysis to understand their “fundability”. This means honestly answering whether the potential market size and growth model align with the VC mandate.

Accumulating Traction: It is necessary to maximize the use of customers and sales channels at the early stage, not depending 100% on investors. Early signs of traction (sales, usage, partnerships) are the best proof that the team is capable of execution.

Focus on the Problem: Successful founders are obsessed with customer pain, iterate based on evidence, and only pivot when new data demands it.

Fundraising Efficiency: Managing Decision Speed

The fundraising process requires time and energy. The founder must actively manage this process, aiming for quick feedback.

The worst outcome is a slow “no,” which drains resources and time. The founder should not fear a quick “no.” If a VC cannot see a path to investment, it is best to know immediately so efforts can be focused on more likely funding sources. The goal is to get a quick “yes” or a quick “no,” avoiding the zone of slowdown.

Investor Selection: A Long-Haul Partnership

Venture capital is a long-term partnership requiring joint work for 7−10 years. The founder must choose a VC who is committed for the long haul.

The founder needs to actively conduct due diligence on their investor, verifying if they meet their needs (e.g., do they have funds to invest at the current stage and does their mandate match the sector). Choosing the wrong investor, based only on the speed of receiving money, can create problems in the future due to misunderstanding investment documents and conflicts in management.

Conclusion and Synthesis: Eliminating Red Flags

The systemic rejection of 99% of ideas occurs at the intersection of two factors: misalignment with the VC mandate (insufficient TAM) and a series of critical errors related to the team, the market, and behavioral discipline. Eliminating these red flags requires not only a strong idea but also a demonstration of operational maturity and strategic honesty.

The following table presents the synthesized requirements of Early-Stage VC Due Diligence, serving as a critical map for founders.

VC Due Diligence Pillars and Pre-Seed Success Criteria

| Pillar of Evaluation | Key VC Criteria (Pre-Seed/Seed) | Red Flag (Immediate Deal Killer) |

| Team | Skills, commitment (100% dedication), ability to execute, presence of a leader. | Failed team/lack of a leader. Lack of relevant experience. |

| Market (TAM) | Addressable market, 10x growth potential. “Must Have” product. | Market too small for the fund’s mandate. “Nice-to-have” product. |

| Product/Traction | MVP/Prototype, unique value proposition, early signs of Customer Validation. | Only an “idea,” lack of proof of concept. Product does not solve a “hair on fire” problem. |

| Finances/Hygiene | Basic financial model (Use of Funds, Burn Rate). Separate accounts. | Commingling personal/business accounts. Lack of key historical data/KPIs. |

| Legal/Structure | Correct incorporation, IP protection, adequate dilution. | Lack of IP protection. High dilution at early stages. |

Behavioral errors that destroy trust are the fastest deal killers. These errors, listed below, undermine the investor’s belief in the founder’s managerial competence and honesty.

Top 5 Fatal Founder Mistakes (Behavioral Red Flags)

| No. | Fatal Error | Manifestation (Instant Deal Killer) | Reason for Rejection (Crisis of Trust) |

| 1 | Metric Distortion/Deception | Providing false or highly exaggerated data; hiding problems. | Kills trust; questions everything the founder says. Reputation becomes toxic. |

| 2 | Strategic Naivety | Statement: “We have no competitors” (including indirect and status quo). | Demonstrates a lack of critical market analysis and industry understanding. |

| 3 | Early Focus on Exit | Including an Exit Strategy slide in the early pitch deck. | Signals short-term motivation; does not align with the VC mandate of building long-term “unicorns.” |

| 4 | Lack of Financial Discipline | Commingling personal and corporate finances (Commingling). | Indicates operational immaturity, potential legal and tax risks. |

| 5 | Weak Communication of Vision | Inability to explain the product/plan simply; unpolished deck. | Investor cannot grasp value in the allotted time. Creates an impression of incompetence. |

Recommendation

For a founder seeking VC funding, it is critical to shift the focus from proving that “the idea is good” to proving that “the team is capable of massive execution.” This includes not only possessing relevant skills but also demonstrating the highest level of financial and legal discipline, strategic maturity in competitive analysis, and, most importantly, absolute honesty and readiness for partnership. Only those startups that pass this multi-level filter—the VC mandate, the five DD pillars, and the behavioral red flag test—can hope to be among the coveted 1% of funded companies.

Catalog of Fatal Errors: Five Instant Trust Killers (Red Flags)

Beyond failing the systemic mandate and not meeting DD requirements, there are behavioral and strategic errors that instantly destroy the most crucial element in the venture world—trust.

Fatal Error 1: Deception, Metric Distortion, and the Trust Crisis

Any, even the slightest, hint of general lack of honesty is an automatic and irreversible deal killer. In the VC industry, which relies on long-term partnerships and reputation, lying is a toxic stain.

Misleading Metrics is the most frequent violation. Founders often exaggerate figures in an attempt to appear more successful. However, investors are well aware that most startups, even successful ones, face difficulties and have inconsistent growth. It is much better to present honest metrics that show the team’s determination than polished data.

Dishonesty does not just deter; it signals the founder’s willingness to lie in business, creating a large liability risk. The startup industry is small, and reputations travel quickly. If an investor catches a founder lying or distorting historical data, they lose trust in the entire plan and vision, which is impossible to verify. VCs openly share information about dishonest founders, which can permanently close doors to further funding.

Fatal Error 2: “We Have No Competition”

This statement is a strategic naivety red flag that makes experienced investors “cringe”. A lack of competitors is a myth. If there are no competitors, it likely means either the market does not exist, or the problem is not worth solving.

Why it is fatal:

Lack of Market Research: The founder demonstrates they have not conducted proper customer discovery and do not understand their industry.

Ignoring the Status Quo: There is always competition in the form of the status quo (how people solve the problem today without your product) and indirect competitors (alternative approaches to solving the problem).

Solution Looking for a Problem: If the founder cannot name how customers currently manage without their product, it is a signal they might be building a Solution Looking for a Problem

Investors want to see a thoughtful analysis of the competitive landscape and a clear articulation of a unique differentiation that genuinely matters to the customer.

Fatal Error 3: Early Exit Planning

Including a slide with an M&A plan or another quick exit strategy in the pitch deck at the early stages is one of the biggest red flags for VCs.

Venture capital invests not to help a founder sell the company in three years. They invest to build a market leader valued in the billions of dollars. Early exit planning signals the founder’s short-term motivation, which does not align with the fund’s long-term (7-10 year) horizon. This creates the impression that the founder wants to “retire” rather than build an industry-changing company.

Fatal Error 4: Inability to Answer Basic Strategic Questions

The founder must have a crystal-clear understanding of the company’s current status, the development plan, and, most importantly, how the raised funds will be used (Use of Funds).

Pitching and Communication Problems

Weak Communication of Vision: Inability to explain the essence of the product in simple, understandable sentences that can be grasped by both a technical investor and a novice. If the investor cannot understand the value in the allotted time, it is an instant rejection.

Unpolished Deck: A sloppy, inconsistent presentation deck often prevents the team from even securing a first meeting.

Fatal Error 5: Avoiding Partnership and Inability to Work with Investors

The inability to work with investors and misunderstanding their role can be fatal for the business. Venture capital offers not just money (Level 1: Money quickly), but also valuable experience accumulated from dozens of failed and successful cases.

The Danger of “The Smartest Person in the Room”: Investors note that if a founder considers themselves “the smartest person in the room” and is unwilling to listen to advice or feedback, it complicates the partnership. Such a founder demonstrates an inability to learn and iterate—skills critical for survival. The investor sees this founder not as a manageable partner, but as a high-risk asset that will likely make “very silly mistakes”. Sportsmanship and a willingness to work together are behavioral criteria for success.

Detailed Checklist: What a Successful Pitch Needs

To pass the rigid selection process, a founder must systematize preparation, focusing not just on the idea, but also on discipline, traction, and strategic maturity.

Overcoming Rejection: Validation Before the Pitch

Before entering the fundraising process, the founder must conduct a thorough analysis to understand their “fundability”. This means honestly answering whether the potential market size and growth model align with the VC mandate.

Accumulating Traction: It is necessary to maximize the use of customers and sales channels at the early stage, not depending 100% on investors. Early signs of traction (sales, usage, partnerships) are the best proof that the team is capable of execution.

Focus on the Problem: Successful founders are obsessed with customer pain, iterate based on evidence, and only pivot when new data demands it.

Fundraising Efficiency: Managing Decision Speed

The fundraising process requires time and energy. The founder must actively manage this process, aiming for quick feedback.

The worst outcome is a slow “no,” which drains resources and time. The founder should not fear a quick “no.” If a VC cannot see a path to investment, it is best to know immediately so efforts can be focused on more likely funding sources. The goal is to get a quick “yes” or a quick “no,” avoiding the zone of slowdown.

Investor Selection: A Long-Haul Partnership

Venture capital is a long-term partnership requiring joint work for 7−10 years. The founder must choose a VC who is committed for the long haul.

The founder needs to actively conduct due diligence on their investor, verifying if they meet their needs (e.g., do they have funds to invest at the current stage and does their mandate match the sector). Choosing the wrong investor, based only on the speed of receiving money, can create problems in the future due to misunderstanding investment documents and conflicts in management.

Conclusion and Synthesis: Eliminating Red Flags

The systemic rejection of 99% of ideas occurs at the intersection of two factors: misalignment with the VC mandate (insufficient TAM) and a series of critical errors related to the team, the market, and behavioral discipline. Eliminating these red flags requires not only a strong idea but also a demonstration of operational maturity and strategic honesty.

The following table presents the synthesized requirements of Early-Stage VC Due Diligence, serving as a critical map for founders.

VC Due Diligence Pillars and Pre-Seed Success Criteria

| Pillar of Evaluation | Key VC Criteria (Pre-Seed/Seed) | Red Flag (Immediate Deal Killer) |

| Team | Skills, commitment (100% dedication), ability to execute, presence of a leader. | Failed team/lack of a leader. Lack of relevant experience. |

| Market (TAM) | Addressable market, 10x growth potential. “Must Have” product. | Market too small for the fund’s mandate. “Nice-to-have” product. |

| Product/Traction | MVP/Prototype, unique value proposition, early signs of Customer Validation. | Only an “idea,” lack of proof of concept. Product does not solve a “hair on fire” problem. |

| Finances/Hygiene | Basic financial model (Use of Funds, Burn Rate). Separate accounts. | Commingling personal/business accounts. Lack of key historical data/KPIs. |

| Legal/Structure | Correct incorporation, IP protection, adequate dilution. | Lack of IP protection. High dilution at early stages. |

Behavioral errors that destroy trust are the fastest deal killers. These errors, listed below, undermine the investor’s belief in the founder’s managerial competence and honesty.

Top 5 Fatal Founder Mistakes (Behavioral Red Flags)

| No. | Fatal Error | Manifestation (Instant Deal Killer) | Reason for Rejection (Crisis of Trust) |

| 1 | Metric Distortion/Deception | Providing false or highly exaggerated data; hiding problems. | Kills trust; questions everything the founder says. Reputation becomes toxic. |

| 2 | Strategic Naivety | Statement: “We have no competitors” (including indirect and status quo). | Demonstrates a lack of critical market analysis and industry understanding. |

| 3 | Early Focus on Exit | Including an Exit Strategy slide in the early pitch deck. | Signals short-term motivation; does not align with the VC mandate of building long-term “unicorns.” |

| 4 | Lack of Financial Discipline | Commingling personal and corporate finances (Commingling). | Indicates operational immaturity, potential legal and tax risks. |

| 5 | Weak Communication of Vision | Inability to explain the product/plan simply; unpolished deck. | Investor cannot grasp value in the allotted time. Creates an impression of incompetence. |

Recommendation

For a founder seeking VC funding, it is critical to shift the focus from proving that “the idea is good” to proving that “the team is capable of massive execution.” This includes not only possessing relevant skills but also demonstrating the highest level of financial and legal discipline, strategic maturity in competitive analysis, and, most importantly, absolute honesty and readiness for partnership. Only those startups that pass this multi-level filter—the VC mandate, the five DD pillars, and the behavioral red flag test—can hope to be among the coveted 1% of funded companies.