Introduction: Why We Keep Talking About Money

I’ve lost count of how many times I’ve been asked the same question by founders over the last 15 years:

“Aleksei, how do I raise money for my startup?”

It doesn’t matter where I am — a co-working space in Moscow, a tech park in Kazan, a coffee shop in Berlin, or a conference in Singapore — the question always comes. And my answer is usually the same: funding is not about the money, it’s about trust.

Money, at the end of the day, is just paper (or more often, digits on a bank screen). Trust is the real currency of venture capital. If an investor doesn’t trust your team, your story, or your numbers, no amount of slides or enthusiasm will help.

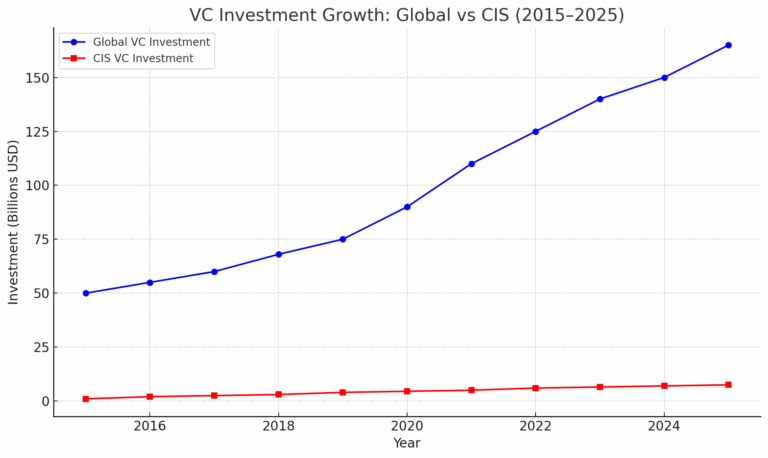

In Russia and the CIS, the journey is harder. Our ecosystem is younger, our exits fewer, and our risks greater. But our talent? Our engineers, our scientists, our founders? They are world-class. I’ve seen teams here that can match — or even out-innovate — their peers in Silicon Valley.

The question is not: “Do CIS founders have the talent?” The question is: “How do they convince the world to back them?”

That’s the journey we’re about to take in this article: a guided, interactive review of the startup funding landscape — Russia, the CIS, and beyond — told not from theory, but from my own experience as an investor, mentor, and Managing Partner of iVenturer Foundation.

Chapter 1: The Global Landscape – Russia vs. U.S. vs. Asia

Let’s set the stage with a simple comparison.

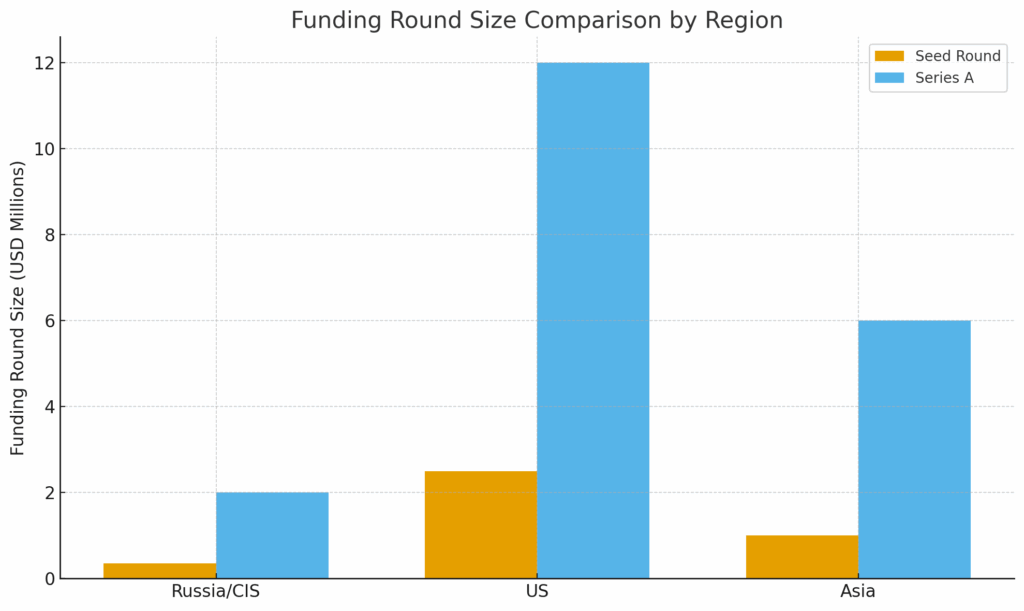

The U.S. — Silicon Valley & Beyond

Average seed round: $2–3 million.

Valuations: aggressive, often based on potential rather than traction.

Ecosystem: highly networked, liquid, with deep pools of angels, VCs, and corporates.

Culture: failure is accepted. If your startup dies, you wear it like a badge.

Asia — Speed and Scale

Average seed round: $500k–$1.5 million (varies widely by region).

Valuations: disciplined, sometimes lower than the U.S. but growing fast.

Ecosystem: hyper-competitive, government-driven in some regions (e.g., Singapore, China).

Culture: scale fast or get eaten. Partnerships with corporates are critical.

Russia & CIS — Cautious Growth

Average seed round: $200–500k.

Valuations: conservative. Investors want proof, not just potential.

Ecosystem: fragmented, with strong government influence (Skolkovo, IIDF).

Culture: investors are skeptical, exits are fewer, compliance matters.

The difference? In the U.S., investors bet on vision. In Asia, they bet on speed. In Russia/CIS, they bet on survival.

This means that if you are a CIS founder trying to raise abroad, you must translate your story into the language investors understand. For Americans: big vision, big market, bold ambition. For Asians: clear scalability and operational discipline. For CIS: resilience, compliance, and smart risk management.

Chapter 2: The Founder’s Dilemma

A founder’s life often feels like standing at the edge of a cliff, asking strangers to help you build a bridge across.

When I mentor founders, I ask one blunt question:

“Why should anyone trust you with their money?”

It forces a pause. Because many assume that having a great idea is enough. It isn’t.

Investors look for signals, not promises. And the five universal signals are:

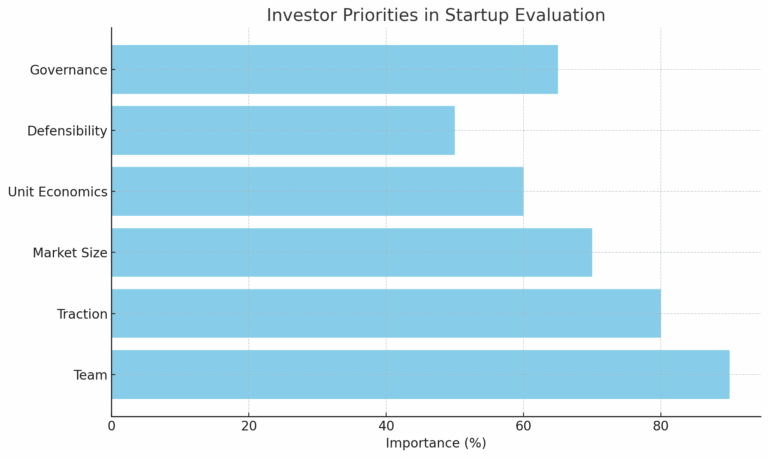

Team. Do you and your co-founders complement each other? Lone founders rarely raise big.

- Traction. Do you have paying customers, or at least active pilots? Even a handful matters.

- Defensibility. Why won’t someone bigger crush you? Is there IP, data, or network effects?

- Unit Economics. Does the math make sense? Even if small, is your CAC/LTV ratio positive?

- Risk Awareness. Do you see your blind spots? Investors forgive risk — but not denial.

I once sat with a deep-tech founder in Moscow. Brilliant biochemist. Nobel-level intellect. But when I asked him about risks, he replied: “That’s why I need investors — to figure those out for me.”

Deal died on the spot. Not because of the science, but because no investor wants to pay to clean up your blind spots.

Chapter 3: Instruments of Capital

Here’s your fundraising toolbox, simplified:

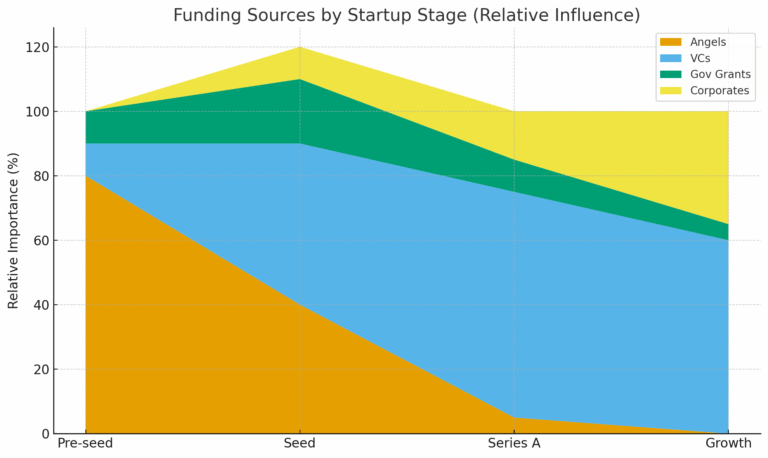

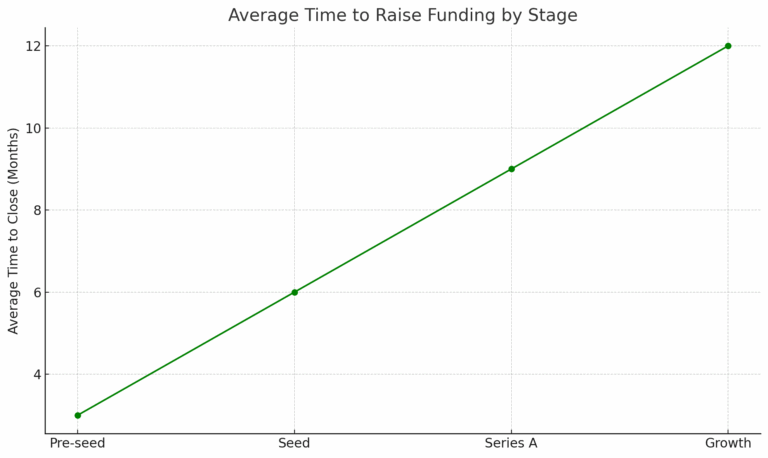

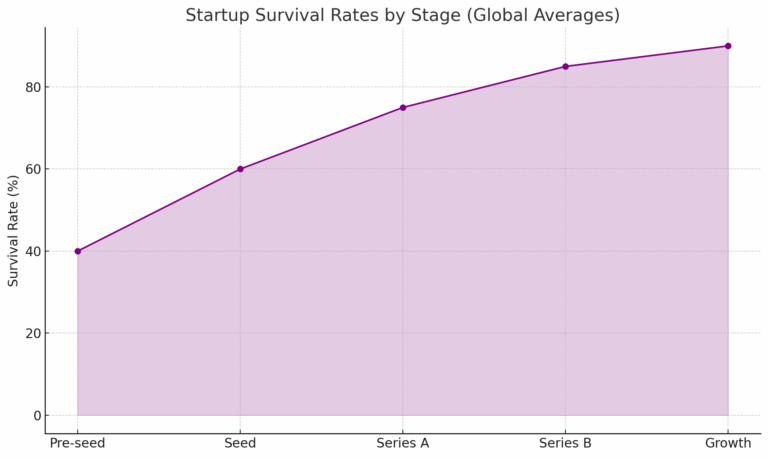

Pre-seed: Angels, family, accelerators. Small checks, but critical validation

- Seed: Convertible notes, SAFEs, small VCs. This is where your first real traction is tested.

- Series A/B: Institutional VCs, corporates. Expect heavy due diligence.

- Growth: Private equity, sovereign funds, international investors.

Trade-offs are everywhere:

- Convertible notes/SAFEs: quick, simple, but dilution risk later.

- Grants: non-dilutive but bureaucratic.

- Strategic investors: open doors, but may lock you in.

At iVenturer, we once worked with a SaaS startup that turned down a local strategic investor because the term sheet gave the corporate too much control. Painful choice at the time — but two years later, the company raised 5x the valuation from an international VC.

Lesson? Short-term money is easy. Long-term alignment is priceless.

Chapter 4: The Art of Storytelling

Numbers alone don’t raise capital. Stories do.

A pitch deck is not a financial document. It’s a narrative. Investors must feel pulled into your story.

Golden Rule: If your grandmother can’t explain your startup in three sentences, your story isn’t ready.

At iVenturer, I coach founders to simplify. Less jargon, more clarity. Less “disruption,” more “here’s the problem, here’s why it matters, here’s why we’re the best team to solve it.”

Chapter 5: The CIS Challenge

Let’s face reality: raising money in CIS comes with hurdles.

Currency volatility. Investors fear ruble returns shrinking against the dollar.

- Sanctions and perception. Even if not directly impacted, optics matter.

- Regulation. Laws change fast, especially around tech and finance.

- Exit scarcity. Few IPOs, fewer local acquirers.

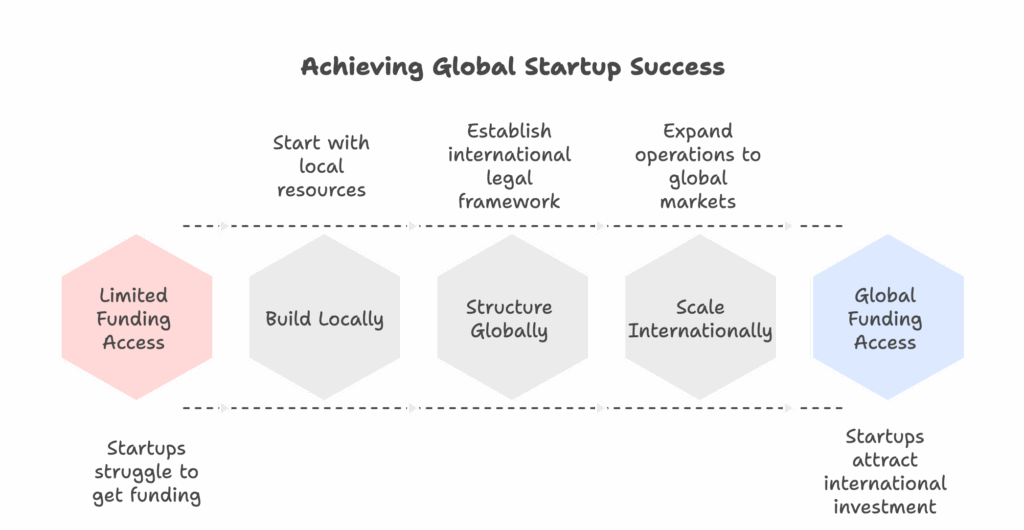

Solution? Structure globally. Most CIS startups raising abroad set up holding companies in Cyprus, Estonia, Singapore, or Delaware. Operations stay local, governance goes global.

This dual structure sends the signal: “We play by global rules.”

Chapter 6: Life After the Money

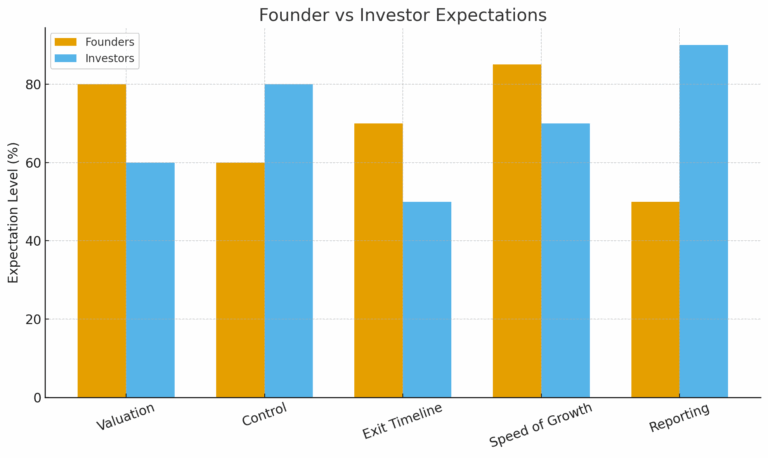

Here’s the irony: most founders think raising money is the finish line. It’s not. It’s the starting line of the real race.

Investors don’t just give you money and disappear. They expect:

Regular reporting (monthly or quarterly).

- Transparency when things go wrong.

Milestones actually hit.

- Governance — real boards, not token ones.

Pro tip: Investors forgive failure. They don’t forgive silence.

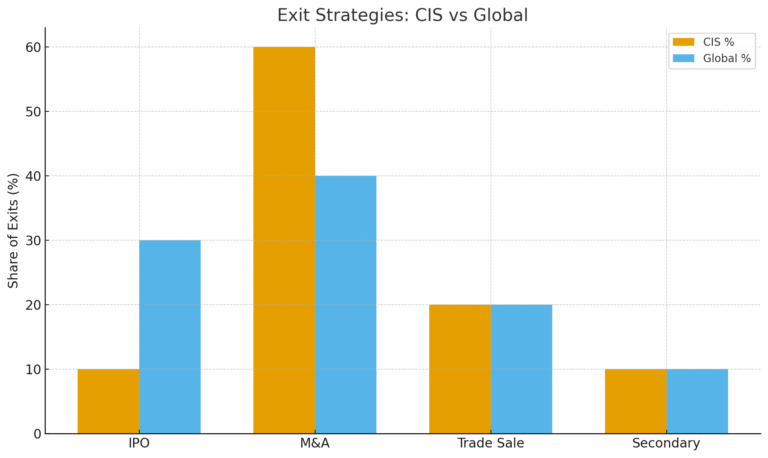

Chapter 7: Exits and the Long Game

In Silicon Valley, exits are a buffet: IPOs, SPACs, acquisitions. In CIS, it’s a short menu: mostly M&A or strategic sales. But that’s okay. Not every startup needs a Nasdaq ticker symbol.

The real long game is this: deliver value. For your customers, for your investors, for society. Exits are a byproduct.

Chapter 8: The Future of Funding

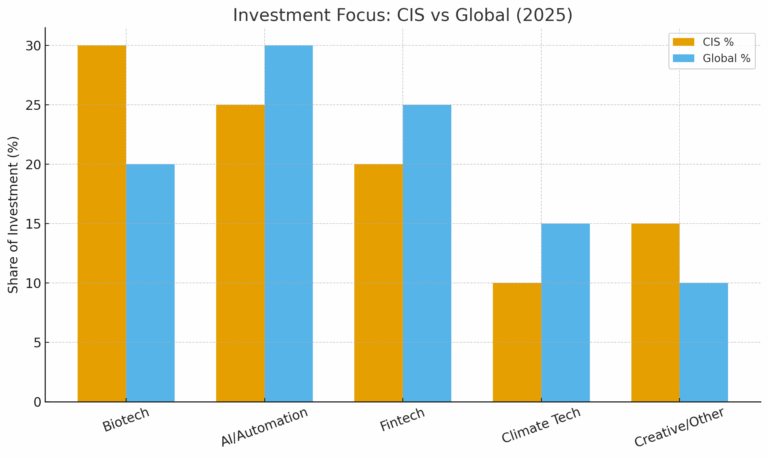

Looking ahead, I see four megatrends shaping startup capital flows:

Biotech & Life Sciences. Aging populations, pandemics, health tech. CIS has deep talent here.

- AI & Automation. Cost-cutting, scaling, transformation.

Climate Tech. Billions in green capital globally.

- Tokenization & DeFi. Still early, but may reshape capital markets.

For CIS founders, the keyword is global readiness. Build locally, structure globally, scale internationally.

Final Thoughts

Startup funding is not about chasing unicorn status. It’s about building trust, step by step, with people who choose to bet on you. The investor on the other side of the table doesn’t just ask: “Will this change the world?” They ask: “Can this founder make my risk worth it?”

At iVenturer Foundation, we don’t just write checks. We build bridges. Between founders and investors. Between local talent and global markets. Between vision and execution.Because in the end, money is just fuel. What matters is who’s driving the car — and where you’re going.

So if you’re ready to structure, to communicate, to partner — then maybe we should talk.

By Aleksei Olin, Managing Partner @ iVenturer Foundation

Ready to Raise? Let’s Talk.

Funding isn’t just about capital — it’s about finding the right partners who believe in your vision and will stand with you as you build.

At iVenturer Foundation, we’ve been empowering founders since 2011, helping over 300 startups structure their growth, connect with investors, and scale beyond borders. Whether you’re a scientist in St. Petersburg, a fintech founder in Almaty, or a creative entrepreneur in Tbilisi, we want to hear your story.

Here’s what you can do next:

Pitch Your Startup — Apply for our upcoming iVenturer Bazaar and present your idea to a network of investors and mentors.

Join Our Network — Get access to back-office support, strategic partnerships, and introductions that go beyond money.

Stay Informed — Subscribe to our insights and reports to stay ahead of global funding trends.

Apply today: https://iventurer.foundation/business-network-member-application-form/

Contact Us: https://iventurer.foundation/contact_us/

Reach out directly: hello@iventurer.foundation

Because money follows structure. And structure begins here.

Subscribe and follow iVenturer’s official social profiles:

Watch related "Professor Obvious' Explainarium" Podcast by Medialectica | Ep.4: "How to Attract Startup Funding in Russia, the CIS, and the World featuring Aleksei Olin"

Whether you’re a founder in Moscow, Almaty, or Tbilisi, this session will help you build a fundraising strategy for today’s volatile markets—with actionable advice you can apply now. Join iVenturer Foundation’s global network to connect with top investors, mentors, and service providers.