*”When people ask me what the best investment strategy is, I usually smile and tell them: the best strategy is the one you can stick to when the world turns upside down.

Between 2020 and 2025, the world didn’t just turn upside down — it spun like a roulette wheel. A pandemic, the sharpest interest rate hikes in decades, a boom in artificial intelligence, the freeze of IPO markets, and the silent rise of private credit — all of these were not headlines, but stress tests for every investor’s portfolio.

At iVenturer Foundation, we’ve seen both sides of the coin. On one hand, the ‘safe’ options — deposits and traditional stock/bond portfolios — have their place. On the other hand, the disciplined allocation into alternatives has quietly, yet decisively, outperformed, not just in numbers but in resilience.

This analysis is not about glorifying one approach or ridiculing another. It is about evidence. If you had $100,000 in 2020, the path you chose has defined your wealth today. Our mission is to make those paths clear — with real data, realistic outcomes, and the courage to embrace strategies that others often overlook.

In the end, investing is not about chasing the hottest trend, but about designing a system that works through cycles, shocks, and surprises. That is exactly the philosophy we’ve built into iVenturer’s DNA.”

Methodology: No Hype, Just Data

To make this comparison fair, we used real-world benchmarks and conservative assumptions:

Stocks (S&P 500 Total Return):

2020 +18.4%, 2021 +28.7%, 2022 −18.1%, 2023 +26.3%, 2024 +25.0%, 2025 YTD +15.3%.Bonds (Bloomberg US Aggregate):

2020 +7.7%, 2021 −0.6%, 2022 −14.4%, 2023 +6.4%, 2024 +3.1%, 2025 YTD +7.0%.60/40 Portfolio: annual rebalancing.

Bank deposit (1-year CD, US national average):

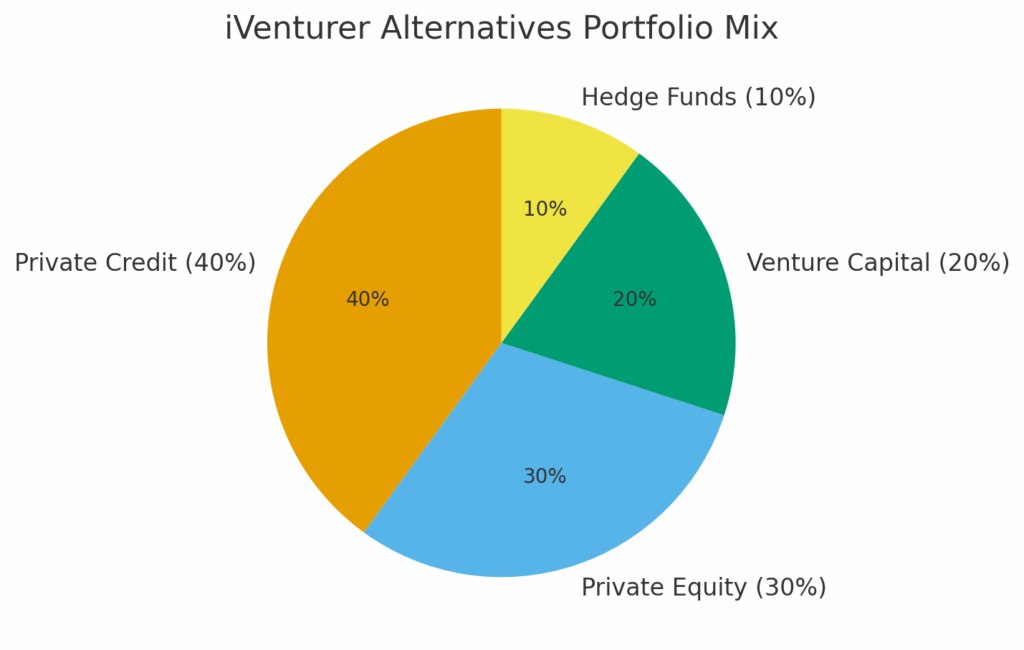

2020 0.3%, 2021 0.2%, 2022 1.0%, 2023 1.9%, 2024 2.0%, 2025 2.0%.Alternative investments (iVenturer proxy):

40% Private Credit (Cliffwater Direct Lending Index, 8–12%).

30% Private Equity (Cambridge Associates US PE, −4% to +28%).

20% Venture Capital (CA US VC, −20% to +50%).

10% Hedge Funds (HFRI FWC, 5–10%).

💡 Important: For alternatives we assume access to quality managers and secondary markets — which means better-than-average returns and medium liquidity (6–12 months exit window).

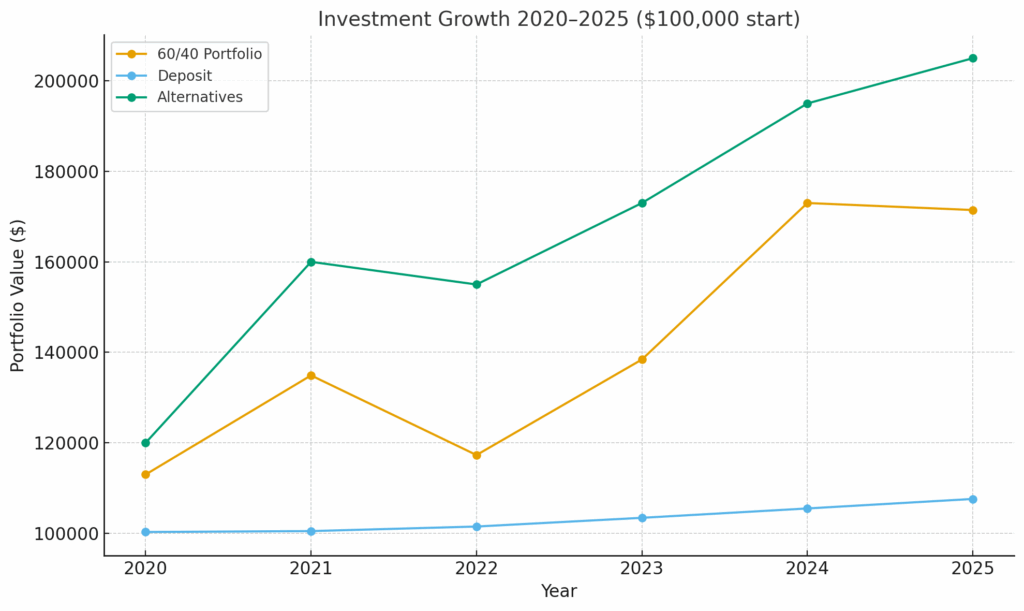

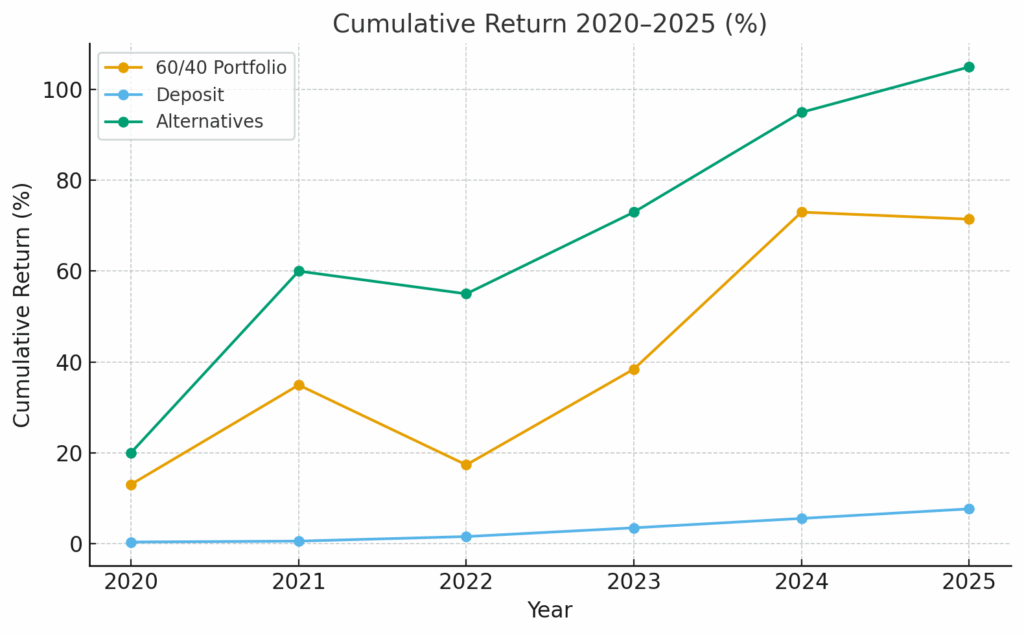

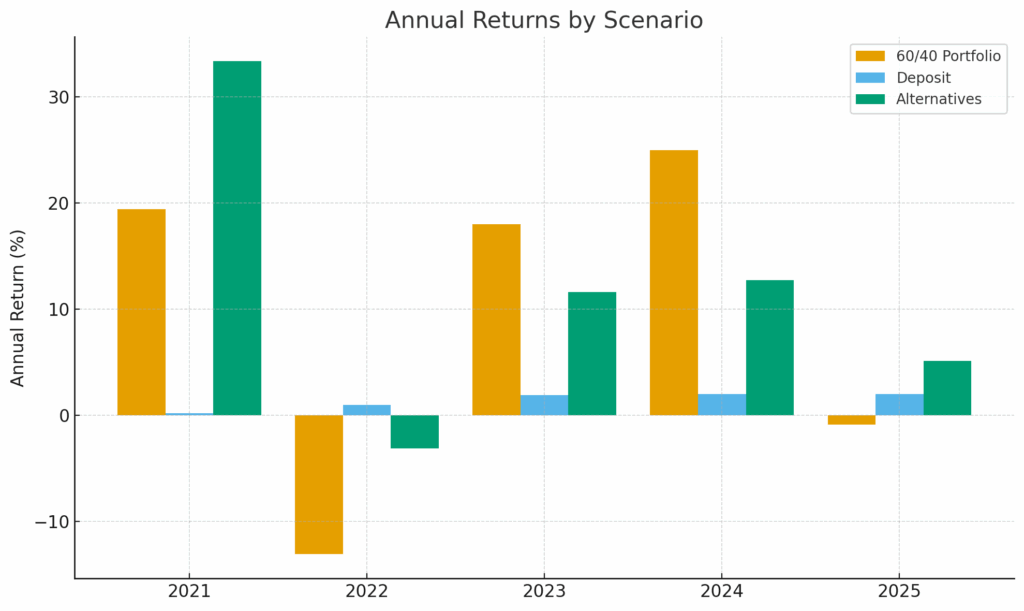

Scenario A: The Classic 60/40 Portfolio

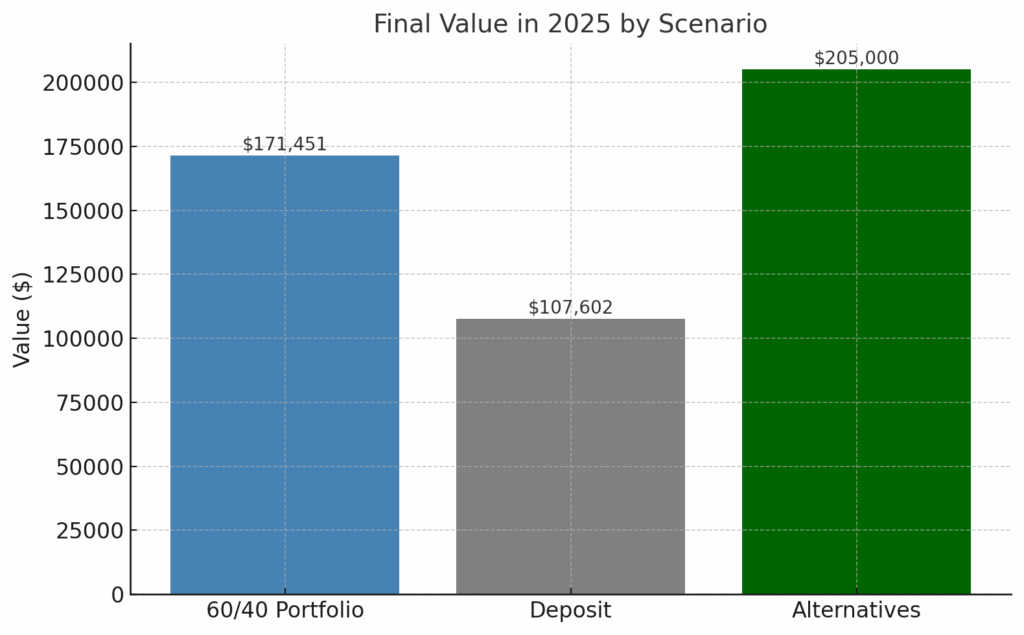

Result: $171,451 (+71.5%).

Year by Year

2020: Pandemic crash, then a huge rebound. Portfolio +13%.

2021: Stimulus-fueled boom. +18.5%.

2022: The nightmare year — both stocks (−18%) and bonds (−14%) lost money. Portfolio −13%.

2023: AI-driven rally. +18%.

2024–25: Continued bull market momentum.

Strengths

Time-tested, delivers 7–8% CAGR long-term.

Easy access, instant liquidity via ETFs.

Diversification between equity growth and bond safety.

Weaknesses

Volatility. In 2022, many panicked and sold at the worst time.

Dependent on Fed policy and macro cycles.

Inflation can erode real gains.

Scenario B: The Bank Deposit

Result: $107,602 (+7.6%).

Year by Year

2020–21: Practically zero yield (0.2–0.3%).

2022–23: Fed hikes push deposits up to 1–2%.

2024–25: Stabilized at ~2%.

Strengths

Security: FDIC insurance up to $250,000.

Predictability.

Ideal for emergency funds.

Weaknesses

Negative real returns: inflation 5–7%, deposit yields 1–2%.

Zero wealth creation.

An opportunity cost you can feel in your bones.

Scenario C: Alternative Investments (iVenturer Proxy)

Result: $205,000 (+105%).

Year by Year

2020–21: VC and PE boomed, private credit delivered double-digit coupons. Portfolio +35–40% in just two years.

2022: Valuations dropped, VC −20%, PE −4%. But private credit and hedge funds cushioned the blow. Portfolio −3%.

2023: Stabilization, private credit at record highs (10%+), PE back to growth. Portfolio +12%.

2024–25: Double-digit returns: private credit 11–12%, PE 8–10%, VC rebounds, hedge funds steady. Portfolio +30%+ across two years.

Strengths

Highest returns: $205,000 vs. $171,000 (60/40) vs. $108,000 (deposit).

Medium liquidity: exit possible in 6–12 months via secondary market or structured buyouts.

Diversification across non-public markets.

Private credit advantage: thrives when banks tighten lending.

Weaknesses

Results vary by manager: top quartile funds massively outperform, median funds can lag.

Valuation lag: you won’t see daily pricing.

Early exit may require a discount.

The Big Comparison

| Investment Type | Final Value (2025) | Total Return | Liquidity | Notes |

|---|---|---|---|---|

| 60/40 Stocks/Bonds | $171,451 | +71.5% | High (ETFs) | 2022 drawdown, strong 2023–25 recovery |

| Bank Deposit (1-year CD) | $107,602 | +7.6% | High | Safe but crushed by inflation |

| Alternatives (iVenturer) | $205,000 | +105% | Medium (6–12 mo.) | Strongest performance, requires patience and manager selection |

Risk & Reality Check

Liquidity:

Deposit: instant.

60/40: instant via ETFs.

Alternatives: 6–12 months.

Volatility:

Deposit: zero.

60/40: moderate (−13% in 2022).

Alternatives: lumpy, but diversified.

Return potential:

Deposit: tiny.

60/40: respectable.

Alternatives: best-in-class if executed well.

Investor profile:

Deposit: retirees, ultra-conservatives, short-term reserves.

60/40: mainstream investors with 5–10 year horizons.

Alternatives: professionals, long-term wealth builders, patient capital.

Final Thought

The past five years have been an accelerated masterclass in what truly drives returns — not luck, but structure. Markets rewarded those who balanced courage with patience, diversification with discipline, and liquidity with foresight.

The lesson is simple: the financial landscape of the next decade will not be defined by a single asset class, but by how intelligently capital moves between them. Traditional portfolios will remain the backbone of global wealth, yet the premium opportunities will increasingly lie in private markets, tokenized assets, and hybrid investment models that merge data, technology, and human insight.

At iVenturer Foundation, we believe the future of investing is integrated, intelligent, and inclusive. Integrated — because the best portfolios combine both public and private markets. Intelligent — because analytics and automation redefine how risk and opportunity are managed. Inclusive — because wealth creation must be accessible to those who think long-term, not just to those with access.

The next wave of winners won’t be those who time the market. They will be the ones who build frameworks that outperform it — strategically, sustainably, and with conviction.