The Russian music industry has undergone significant transformations in recent years, shaped by geopolitical tensions, technological advancements, and shifting consumer preferences. Following the exodus of major Western companies and platforms due to sanctions, the industry has demonstrated resilience and adaptability. As Western firms consider re-entering the market with the potential lifting of sanctions, the landscape offers a mix of challenges and opportunities for stakeholders.

Key Trends in the Russian Music Industry

1. Artist Management

The management of artists in Russia has faced disruptions due to emigration and censorship. Many prominent musicians have left the country, while others have adapted to stricter regulations on content.

Gleb Lisichkin, founder of Horizont Label Group, noted that “the situation in Russia is becoming more highly regulated,” with increased state oversight on artistic expression.

Despite these challenges, local artist management firms have stepped up. Companies like VK Music and Yandex Music have begun integrating artist services into their platforms, offering tools for promotion and monetization. This localized approach has allowed emerging artists to gain visibility despite the absence of global players like Spotify and Apple Music.

2. Revenue Streams

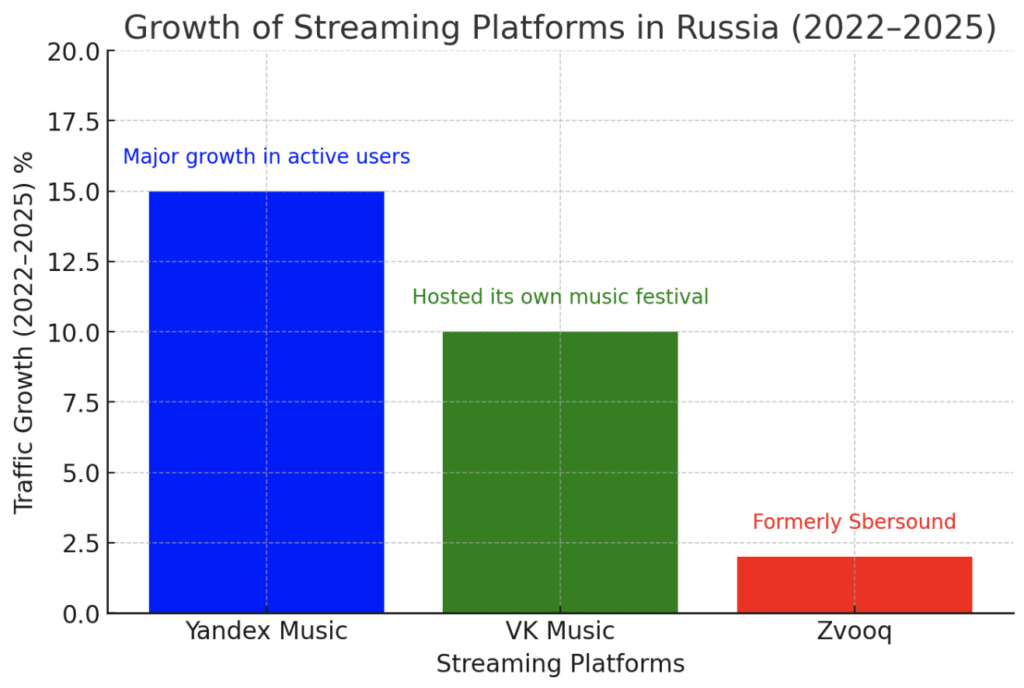

The departure of Western streaming giants has shifted revenue dynamics. Local platforms such as VK Music and Yandex Music have seen significant growth, with streaming traffic increasing by 10% and 15%, respectively. However, piracy remains a persistent issue, undermining potential revenue.

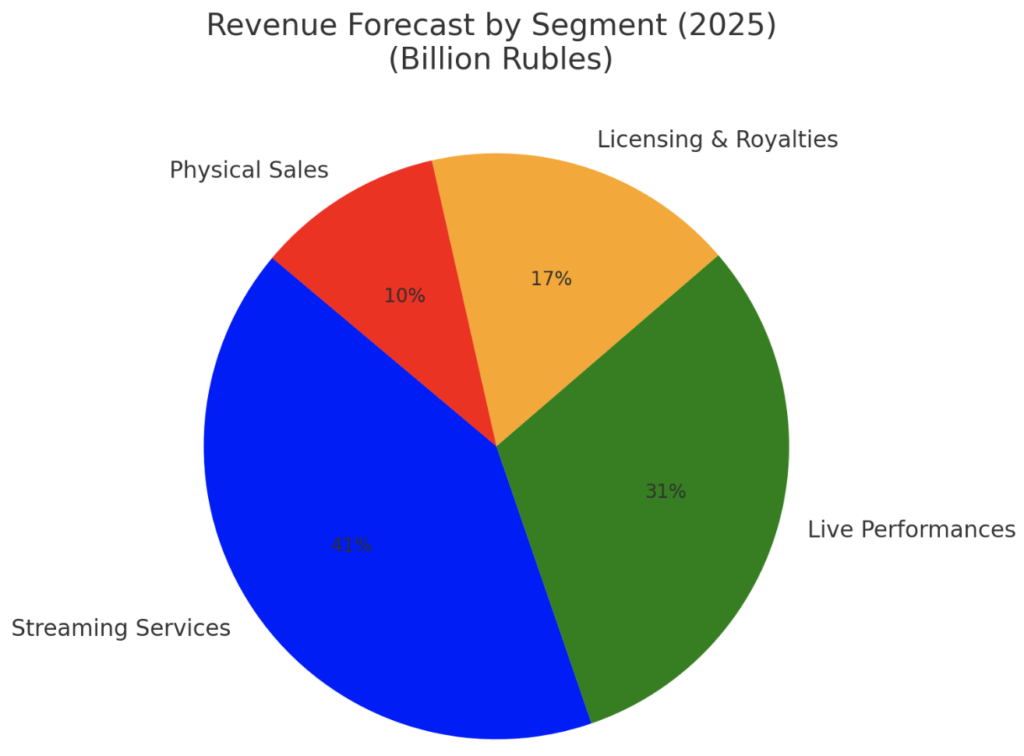

Additionally, live performances are regaining prominence as a key income source for artists. Festivals organized by platforms like VK Music have become central to the ecosystem. Licensing deals for film and television have also expanded, with Russian-made music filling gaps left by the unavailability of foreign tracks.

3. Royalties and Licensing

Royalties collection in Russia has historically been inefficient, with artists often struggling to claim their earnings.

Sergey Zhukov from “Ruki Vverkh!” highlighted these inefficiencies, noting that royalties from Western markets far exceeded those collected domestically. However, recent efforts by local organizations aim to streamline royalty distribution through digital tools.

The licensing landscape has also evolved. Companies like MTS have entered the music publishing space, creating opportunities for mid-level indie artists to monetize their work.

Perspectives on Western Re-Entry

The potential return of major Western labels like Universal Music Group, Warner Music Group, and Sony could revitalize the industry but also introduce competition for local players.

Aleksei Olin from iVenturer Foundation remarked: “The re-entry of Western companies will bring expertise and resources but must align with the unique dynamics of the Russian market.”

Western re-entry could:

Reintroduce global best practices in artist management.

Enhance royalty collection systems through advanced technologies.

Provide international exposure for Russian artists.

However, this return may also marginalize smaller local players who have thrived in a more insulated environment.

Strengths of the Russian Market

Resilient Consumer Base: Despite geopolitical challenges, Russian consumers have embraced local platforms for streaming and discovery.

Cultural Richness: The resurgence of genres like chanson-rap demonstrates the industry’s ability to innovate within traditional frameworks1.

Technological Adaptation: Platforms like VK Music leverage AI-driven recommendations to enhance user experiences.

Growth Projections

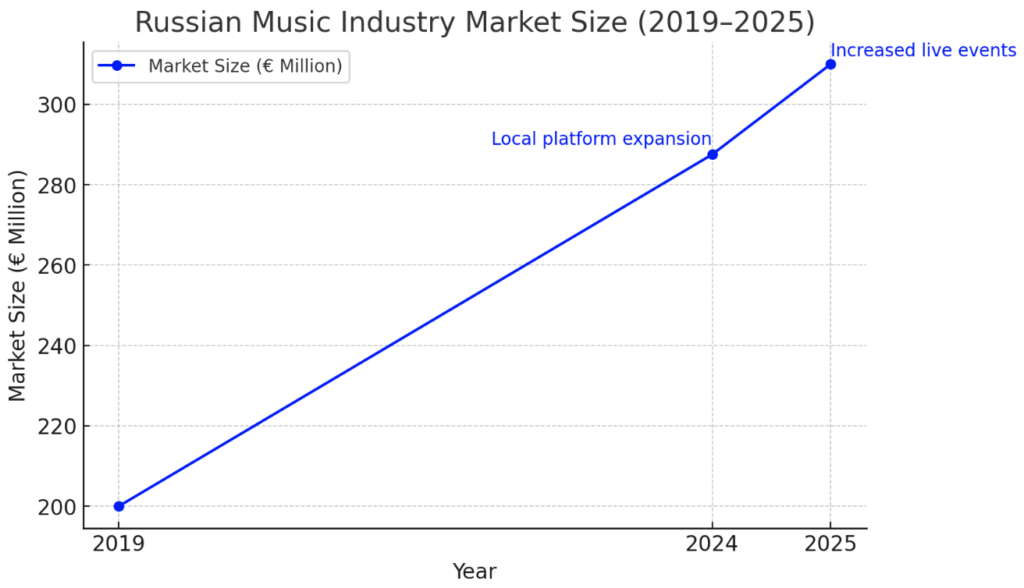

The Russian music market is expected to grow moderately over the next five years:

Streaming services will remain a dominant revenue stream as internet penetration increases.

Live events are projected to recover fully post-pandemic, contributing significantly to artist incomes.

The integration of music into lifestyle apps (e.g., fitness) will further drive subscription-based revenues.

Aleksei Olin predicts: “With strategic investments in technology and artist development, the Russian music industry could achieve annual growth rates of 5–7%, even amid global uncertainties and the next chapter for Russian music will be written by those who can blend tradition with innovation while navigating an increasingly interconnected world.”

Conclusion

The Russian music industry stands at a crossroads. While it has demonstrated remarkable resilience in adapting to sanctions and global isolation, its future depends on balancing local innovation with potential international collaboration. The return of Western companies could catalyze growth but must be carefully managed to ensure equitable opportunities for all stakeholders.